HOME | ABOUT US | MEDIA KIT | CONTACT US | INQUIRE

HOME | ABOUT US | MEDIA KIT | CONTACT US | INQUIRE

Searching for Solutions: More HR executives are wrestling with the varying demands of a multi-generational work force and the challenges of managing both health-insurance costs and ACA compliance.

For those pursuing innovation as they toil in the fields of employer benefits programming, the ground remains as fertile as ever. Studies by various interest groups identify seemingly endless opportunities for improving company bottom lines and employee lives. To wit:

Stress-reduction measures. Because stress, in all its forms—including emotional, financial, job-related—gouges a $300 billion hole in corporate earnings potential every year.

Substance-abuse treatment and prevention. Because alcoholism and use of both legal and illegal drugs is estimated to have a $119 billion impact on business costs.

Grief-reduction. Because factors outside the job, such as divorce or the death of a loved one, account for $75 billion in lost productivity.

Workplace safety. Because the impact from occupational injuries and workplace deaths is pegged at $48.6 billion nationwide, and workplace violence costs add another $36 billion.

While larger companies with greater resources continue to attack the challenges of those and other issues, the small and mid-size businesses that would like do the same find it increasingly difficult to keep their eyes on the ball. Jim Clay, president of the employee-benefits division at the Miller Group, knows what’s distracting them:

“The oxygen,” Clay says, “is getting sucked out of room because of all the energy going into ACA.” That would be the Affordable Care Act, the law of the health-care land. Every day, more executives are finding new levels of irony in name of that legislation, because compliance with it is anything but affordable. “The bottom line,” says Clay, “is that the more you know about ACA, the more you become cynical. You have to become cynical—or go into denial.”

As costs for compliance with ACA continue to rise in tandem with the costs of employer-provide health insurance premiums, companies have painful choices to make. Not just about how the health-care piece will be designed and what benefits and coverages will be included in that segment, but how they can enhance—or in many cases, simply retain—the non-health-related benefits. The pie is only so big, and as health care commands ever-larger slices, the rest of it is getting squeezed.

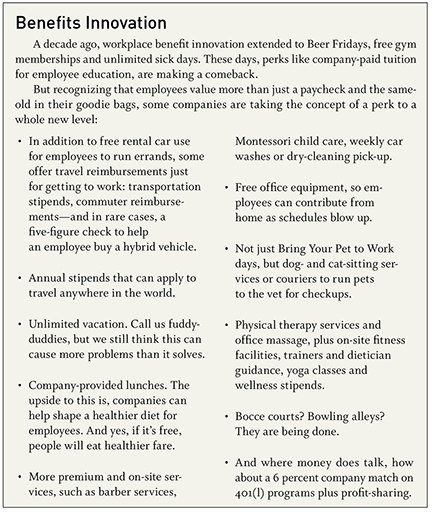

That pressure is generating no small amount of hand-wringing and hair-pulling in the HR offices, benefits-design executives say, but it’s also leading to some innovative approaches to program design. Here are just a few:

Scheduling flexibility. Some companies, even within manufacturing settings that require fixed production processes, have found that they can accommodate earlier shift starts, later starts, split shifts and other tactics with individual employees and still maintain their production timetables, while improving employee job satisfaction.

Increased parental leave. Few companies will follow the lead of a Netflix, which first instituted a policy of up to a year of paid leave for new parents, then earlier this month made it unlimited. This, despite the implicit replacement and training costs and blowback from childless employees who might be asked to pick up the slack. Still, more companies are granting longer paid leave (in part, following a presidential directive to provide six weeks of paid time off for federal employees).

Subsidized child care. As stressful and demanding as a new child in the family can be, the longer-term challenges of balancing work and child-rearing is even more so. As a result, some companies are underwriting child-care costs, in part or in full. And larger ones, as we’ve seen with Burns and McDonnell locally, are opening their own day-care facilities for employees.

Food. This is a two-edged sword, but some companies have found that free or reduced-cost lunches and snacks can help maintain high productivity levels, for a number of reasons. First, employees stay in the building, and are likely back to work sooner than those who go out for lunch. Second, it allows the companies to link that productivity to their health-care initiatives by ensuring that healthier fare is available. The other edge of that sword, of course, being the “food dump” phenomenon, and keeping a lid on the doughnuts, cakes and cookie trays.

Telehealth. It’s not just an urban doctor/rural patient phenomenon; some employers have made arrangements with health-care providers for telehealth consultations that dramatically cut down on time lost for visits to a doctor’s office. Larger companies have invested in their own on-site clinics, because nothing kills half a workday like the 2 p.m. medical appointment, which often means employees aren’t back until the following morning. (If only dentistry could be administered the same way.)

Financial literacy courses. Rather than one-time seminars on savings and retirement planning, some em-ployers have found that they can make meaningful impacts on their work force with recurring courses on savings and investment. Those employee choices, after all, are essential elements in the success of defined contribution retirement plans, so influencing positive outcomes there can alleviate stress in both short and long term.

Weight-loss surgery. One of the most dramatic examples of a company engaging in employee wellness came when Caeser’s Entertainment Corp. adopted a policy of paying for bariatric surgery. After Harrah’s acquired the company a decade ago, it extended that for the entire work force of 40,000. Reason? Most of the factors that were driving up health-care costs across the company were related to obesity and employees’ being overweight.

Some of those approaches are scalable for smaller businesses, some will forever be out of reach. But through 2018, when the compliance pig has run its course through the ACA python with (presumably) full implementation of the law as it stands today, many companies will have to set innovation aside to deal with the issue bearing down on them: The costs of providing employee health care, and the administrative toll being levied on top of that for compliance.

Here’s a bit of an inside-baseball anecdote to give you some idea of how confounding, confusing—and expensive—compliance with ACA has already become. The article you are reading will be approximately 1,900 words in length. Earlier this month, Lockton Benefits Group issued an employer advisory, pointing out some of the potential risks in what it labeled “Mind-Bending Tax Administration Issues” raised by the so-called Cadillac tax on health-insurance plans.

In a single example to demonstrate the complexity of the IRS reporting requirements, Lockton needed more than 1,800 carefully chosen words to describe whether the tax applied in a given set of circumstances, how it should be allocated if it did apply, confusion over the entities liable for collecting and submitting the tax payment, determination of the costs involved, and even possibility of a tax on the tax itself.

Keep in mind: the Cadillac tax is a small piece of the overall ACA reporting requirements for most businesses. The process of retaining and administering a health-care plan, which has grown increasingly complex since ACA’s passage in 2010, is about to get even more harrowing.

“The part they’re wrestling with most is the reporting piece with employers, tracking all the IRS forms, determining whether somebody was covered and for how many months, figuring out whether it’s all affordable,” says Jeff Spencer, vice president of Holmes Murphy & Associates.

Much of that impact was delayed for a year in the mangled rollout of ACA regulations, but more of those have been defined and now, Spencer says, employers are struggling to determine what data is needed to remain compliant, how the reporting will be done, and where the necessary information can be found. “It’s all piecemeal at this point,” he says, so payroll vendors will play greater and more important roles, because much of the needed data, but nowhere near all, lives on their servers.

“Piecing this together from multiple sources is a challenge, and the IRS still hasn’t finalized the regulations,” Spencer said. “You may know today what you need to get and where to find it, but the caveat to employers is that the rules may change by the time they get everything set up.”

One of the most important dynamics taking place at larger employers, said Rob Sweatt, executive vice president with Lockton Benefits, was the need for HR executives “to get a seat at the table with executive management to create an awareness of the challenges they’re dealing with.”

Rapid changes in complexity and costs of the health-care benefits now make it essential, Sweatt said, for companies to ensure that their HR strategies are aligned with the overall business strategy. “These things no longer can be effective if they’re operating in silos, which is how it’s been historically,” he said.

Before ACA, he said, it was harder to attain that level of C-suite engagement because the pressure wasn’t as intense as it’s becoming with implementation. After the Supreme Court upheld ACA’s constitutionality as a tax, “there was a very, very quick reaction from senior management that ‘This thing is here to stay, so now what do we do?’ ” Sweatt said. “It seemed that almost overnight, CEOs and presidents took a much keener interest in the health-care spend, with the recognition that this thing was not going away.”

As a consequence, Sweatt said, “HR professionals are becoming more instrumental in managing that spend from a total-compensation approach—we like to call holistic—where all pieces that cost money are viewed together. The pool for that is obviously finite, and the health-care spend is the biggest after payroll, but it’s taking a greater proportion of these overall expenses.”

Joe Sevcik, senior vice president for marketing at Assurant Benefits, noted that companies are being affected in different ways based on their employee size. After the one-year implementation delay, 2015 is the trigger year for those with 100 or more employees, and they are furthest along with their data-gathering and processes needed to address reporting and compliance. In 2016, companies with 50-99 employees will be required to provide minimum essential coverage, and they’ll feel the most pain in the coming year.

“For 2016 IRS metrics, that is pretty much done because they’ve used these as look-backs to see if companies have over 50 employees,” Sevcik said. “The other thing is, if you go over 100, you don’t have to offer metallic plans”—those designated as bronze, silver, gold or platinum. “For any employer looking to manage that employee population, that work is pretty much done,” he said, “so we’re really getting the plans in place and planning from there. Often what comes with some of these is higher deductibles, and for some, this is the first time they’ve moved to a high-deductible plan, so there’s a lot of strategy and planning that goes along with that side.”

Last year’s delay in implementation allowed many smaller companies to move from October renewal dates on their health plans and push that to December. While that may have bought time to address compliance issues, it’s done nothing to alleviate the pressure on costs. “What we hear anecdotally from the broker community, and what seen is a lot of rate-filing requests of up to 50 percent increases,” Sevcik said. “Some of that still has to get approved and get negotiated down, but medical rates, regardless of what’s approved, have been outpacing inflation for some time, pre- and post-ACA.”

It all adds up to a confounding, confusing and continually changing environment, executives say.

“For smaller companies, they’re really leaning on us to do more for them than in the past,” said Spencer. “We’re serving as an outsourced HR department, making sure that they’re covered from a compliance standpoint, writing them an HR handbook. In the old days, we’d meet once a year, they would pick their options, have lunch, and play golf. Now, we have to be on top of communications compliance and reporting every day, and that’s push-ing responsibility to our side of the equation.” And, it appears, his golf game has suffered as a result of it.