HOME | ABOUT US | MEDIA KIT | CONTACT US | INQUIRE

HOME | ABOUT US | MEDIA KIT | CONTACT US | INQUIRE

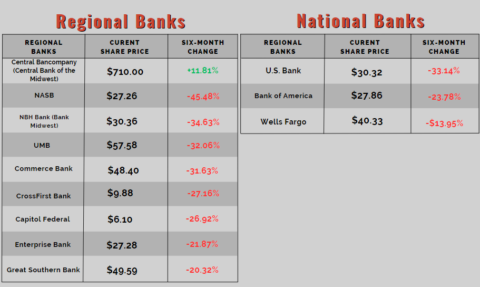

Stock prices for publicly traded banks in the Kansas City region show that most have leveled off from the sector-wide plunge induced by three major bank failures in the U.S. this year, but share prices overall remain sharply lower than they were at the close of 2022.

Graph illustrating bank stock percentage change over the past six months. Graph: Canva

Across the board, share values are down between 20 percent to as much as 45 percent, though recent weeks have seen most banks’ stock prices leveling off after the initial plunge. That downturn began in mid-March, where Silicon Valley Bank in California (with $209 billion in assets) and Signature Bank in New York (with $110 billion in assets) both went down within 48 hours of each other.

That triggered a free fall in banking-sector stocks, the local impact of which shown in the accompanying chart of the biggest publicly traded banks operating in the Kansas City market. Prices were starting to level off when on May 1, the biggest failure of the year took down First Republic Bank of San Francisco, with $229 billion in assets.

One exception to the rule: Central Bancompany, the Jefferson City-based parent of Central Bank of the Midwest, which is up nearly 12 percent over the past six months.

Posted June 1, 2023