HOME | ABOUT US | MEDIA KIT | CONTACT US | INQUIRE

HOME | ABOUT US | MEDIA KIT | CONTACT US | INQUIRE

Major companies headquartered in the area have seen a significant realignment since 2003.

To quickly recap, the large public companies of 2003 that are no longer around include:

Another significant change came with the acquisition of Gold Banc Corp., previously a Top 25 public company, by M&I Bank in 2006. M&I itself was acquired by BMO Harris in 2011.

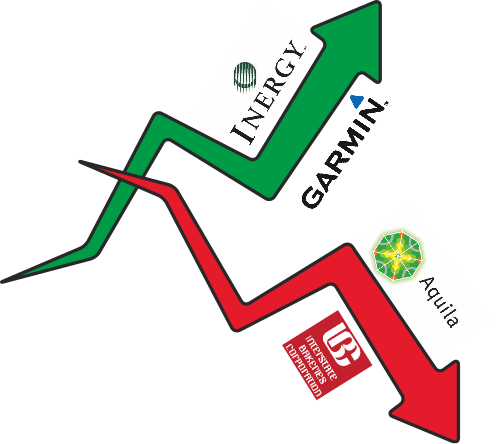

With some of those brands swept away from the rankings, it’s easier to see how innovation has reshaped the list. For starters, this year’s No. 5 company, Garmin International, didn’t even crack the Top 25 list in 2003, reporting 2002 revenues of just $142 million. That leap reflects 20-fold growth, to $2.72 billion in revenues for 2012, for the world’s leading maker of global-positioning hardware.

Inergy, Inc. also surged up the charts, from No. 23 in 2003 to nearly the Top 10 this year following a decade of strategic acquisitions that drove revenues past the $2 billion level for the first time in 2011 and again in 2012.

And in a testament to its ability to take a punch, YRC Worldwide remains a Top 5 company (No. 3 this year, with revenues of $4.9 billion), despite five difficult years of losses and wholesale changes in the C-suites.

Missing from all those calculations is Aquila Inc., once considered the crown jewel in the region’s public-company tiara. After professing revenues of more than $40 billion for 2001 and laying claim to being Kansas City’s biggest public company, Aquila quickly faded. It had to restate its numbers in the wake of the

Enron scandal and its domino effects on energy companies, couldn’t be ranked in 2003 while its actual revenues were being recalibrated, and eventually was broken up and sold in 2007.

Aquila’s downfall cleared the way for Sprint, the region’s leading employer, to assert its rightful place as the largest public company based here. And yet, the challenges for the Overland Park telecom firm have been profound. The 2005 merger with Nextel proved calamitous, if not disastrous, and a resulting write-down of nearly $29.7 billion in the fourth quarter of 2007 wiped out a small gain that would have represented a three-year revenue winning streak.

Since 2008, Sprint has posted annual losses of between $2.4 and $4.3 billion—nearly $16 billion overall. But the company continues to push ahead with innovative technologies that analysts say have positioned it for recovery and longer-term growth. And its stock price recently broke the $6 level for the first time since the precipitous plunge from its all-time high a little more than a decade ago.

The company has nearly halved its Kansas City work force, but still remains a dominant figure there, with 7,000 employees. In that regard, Sprint is like its Top 25 brethren: After half a decade of recession and tepid recovery, the 25 largest private companies as of 2013 are considerably leaner than the 2003 cohort. Overall employment among the top 25 has gone from about 285,000 for the Top 25 in 2003 to less than 200,000 today.