HOME | ABOUT US | MEDIA KIT | CONTACT US | INQUIRE

HOME | ABOUT US | MEDIA KIT | CONTACT US | INQUIRE

Complex multiple factors, however, can blur the varying levels of risk and return.

In today’s low interest rate environment, investors are constantly searching for opportunities to obtain income without exposing their portfolio to a high level of credit risk. Investment advisers who analyze U.S. credit often target high-quality credit investment areas. These not only can help diversify a portfolio, but also have the potential to offer better risk-adjusted returns as a result of being in an area of credit that is less understood and/or relatively inefficient. Thus, investors can capture income and potential total return without a commensurate amount of credit risk.

As an example of such an area, the $3.8 trillion U.S. municipal bond market is one of the most diverse spaces within fixed income. The market is made up of securities issued by states, territories, municipalities and various public authorities (housing authorities, port authorities, etc.) to finance public-purpose projects. The issuers borrow in the municipal bond market for a variety of reasons, such as building a new road, school sewer line or courthouse. Most of the securities issued within the market are federally tax exempt and exempt from taxes from the state of issuance (e.g. the interest paid on most municipal securities issued from entities in California are exempt not only from federal taxes but state taxes as well).

As an example of such an area, the $3.8 trillion U.S. municipal bond market is one of the most diverse spaces within fixed income. The market is made up of securities issued by states, territories, municipalities and various public authorities (housing authorities, port authorities, etc.) to finance public-purpose projects. The issuers borrow in the municipal bond market for a variety of reasons, such as building a new road, school sewer line or courthouse. Most of the securities issued within the market are federally tax exempt and exempt from taxes from the state of issuance (e.g. the interest paid on most municipal securities issued from entities in California are exempt not only from federal taxes but state taxes as well).

Over the past decade, issuance within the municipal market has been roughly $385 million per year, with 35 percent of the issuance being General Obligation (GO) bonds and 65 percent of the issuance structured as revenue bonds.

Over the past decade, issuance within the municipal market has been roughly $385 million per year, with 35 percent of the issuance being General Obligation (GO) bonds and 65 percent of the issuance structured as revenue bonds.

For several reasons, we believe the municipal market is relatively inefficient when compared to other traditional fixed-income markets. For example, the market consists of tens of thousands of issuers, all of which have different revenue streams pledged to the repayment of debt. The owners of a large portion of the market are individual bond holders who had historically relied on monoline bond insurance. Since the crisis, the financial standing of monoline insurance companies has deteriorated with these companies having been subject to ratings downgrades. Unable to solely rely on the backdrop of insurance, market participants have been forced to perform a deeper level of credit work akin to the depth of work seen typically by a professional asset management firm. As one example, many municipal sectors overlap with corporate sectors (e.g. healthcare), so there is a need to not only understand the municipal side of credit, but also the corporate credit aspect as well.

Historically, rated municipal bonds have defaulted at much lower rates than corporate bonds with an equivalent rating. That said, the recent defaults of various Puerto Rico bonds and the increasing levels of underfunded pensions throughout many parts of the country highlight the need for rigorous bottom-up credit analysis along with strong risk-management.

Historically, rated municipal bonds have defaulted at much lower rates than corporate bonds with an equivalent rating. That said, the recent defaults of various Puerto Rico bonds and the increasing levels of underfunded pensions throughout many parts of the country highlight the need for rigorous bottom-up credit analysis along with strong risk-management.

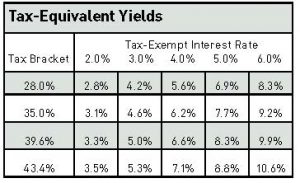

Given the historically high-quality nature of the investment-grade mun-icipal market, municipal bonds may be a good alternative or supplement to a traditional core portfolio for investors who can take advantage of the tax-exempt income. The taxable equivalent yields (as shown at left) on municipal bonds can be attractive, especially for investors in high-tax jurisdictions.

Finally, another important factor to consider when looking at any new asset class is the level of diversification that it can offer a portfolio. Given that the municipal market comprises many diverse subsectors, it is important to understand the respective economic drivers of each subsector and how they correlate with not only your municipal bond portfolio, but also your overall portfolio.

For example, the health of a toll road and a higher-education institution have very little correlation to one another. While investing in a large, inefficient market such as municipal bonds may offer diversification and solid tax-adjusted yields, it does come with risk, and there are always many other factors that must be considered: interest rates, mutual fund flows, liquidity, duration, etc. Please consult an adviser or an asset management firm qualified to perform the due diligence essential to investment success.