HOME | ABOUT US | MEDIA KIT | CONTACT US | INQUIRE

HOME | ABOUT US | MEDIA KIT | CONTACT US | INQUIRE

You’ve worked for years, decades perhaps, to build a business. It’s time to sell. At this point, it’s just a matter of finding the right buyer, isn’t it?

Frankly, no. Because the fiscal land mine in that question is “right.” Think a little deeper and you’ll begin to see that the word can have many applications. It can be someone who will safeguard your business legacy, and the future of your employees, by coming from within the organization. It can be a competitor, who understands how to maximize the value of what you’ve created. If all you’re really interested in is the final price, it can be the person with the biggest bank account. If you’re looking for a clean break and a chaise lounge in the Caribbean, it can be someone who won’t have to tie you up for years during a transition.

For those reasons, and myriad others, the concept of finding the right buyer merits its own place on the checklist of things you have to do to maximize the value of your business sale. Sure, a big payoff would be nice, but think in terms of the most qualified buyer, industry professionals in the acquisitions space say. What you’re doing is orchestrating a marriage, and one that rarely comes from love at first sight. So preparation will always be the key.

“Finding the right buyer is a lit bit like buying a house: You may love the back yard and hate the guest bathroom. It’s a bit of a tradeoff,” says Mike Anderson of Bridgepoint Investment Banking. “When you find a buyer, they may have the right price but you don’t like the terms. Or they may have wonderful terms, but at a lower price.” Anderson says he coaches sellers to identify their most important reasons for selling, and “then accept the fact that there is no perfect buyer, but there is a right buyer.”

Assuming you’ve already done the hard work of improving the curb appeal by placing operations on a profitable growth track, locking up key clients and your most valuable talent, cleaning up the books and regulatory paperwork, etc., you can start to think about determining what your business is worth and matching that number to the correct field of candidate buyers. Set the price too high, and you can scare away some buyers; go the other direction, and you could be leaving serious money on the table.

It could be anyone: Family, friends, clients, vendors, competitors or complete strangers. It could be companies looking to get into new lines or vertically integrate. Knowing the range of buyer motivations is key to positioning your company for the deepest possible candidate field.

Underpinning any motivation, said Dan Danford of the Family Investment Center, are the financials. “The numbers must make sense,” he said. “Somehow, the buyer needs to generate enough revenues to service the loan and pay him- or herself. Even if they have the money without borrowing, they need to make a return on that money that exceeds what it was making before the purchase. Naturally, you want someone that will care for your customers and honor your legacy, but it can’t happen unless the numbers work.” Failing to secure that depth is one of the biggest mistakes a seller can make, said Anderson.

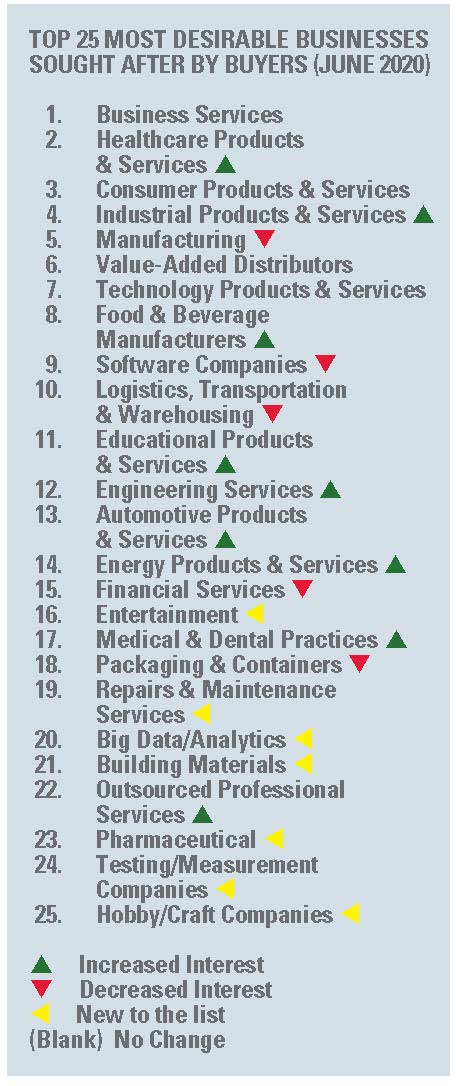

Source: O’Keeffe & O’Malley

Professionals in the field ave access to large rosters of companies looking to make acquisitions; in some cases, firms like his can produce a list of 100 or more qualified buyers for a given company within a day. “People are not aware there is a better way to run a process. If you simply call your CPA and lawyer and they know somebody who might be interested, that’s not a process—that’s a blind date,” Anderson said. “Here’s an example: Earlier this year, we had 12 bona fide, qualified potential buyers for one business, and had it not been for the coronavirus causing some to pull out, we would have had six or seven beautiful offers. That’s a process. Without one, it’s worse than a blind date, it’s a blind date and marriage. The process allows you to find the right buyer.”

But understand that two types of buyers are out there: strategic buyers, who see your company fitting into their long-term growth strategies, and financial buyers, who are looking to acquire a revenue stream. Generally speaking, brokers say, strategic buyers are willing to pay more to make a key acquisition.

Strategic buyers, says Danford, include competitors, which can alter the sales dynamic a bit. “Selling to a competitor is very common, but not something that owners automatically think about,” Danford said. “In some dramatic cases, they may have actually been antagonistic towards each other … yet, competitors often understand the industry and opportunities better than others. Of course, look to employees, family members, or area entrepreneurs. But don’t overlook competitors; they may have more interest and cash than anyone else.”

A well-known business may not need to work as hard to find buyers if word is out that it’s on the market, but most companies don’t fall into that category. Yes, you could ask around at the country club or among family and friends, even check Web sites and trade publications for leads on buyers. But even though there will be a cost for the services, deep lists of existing buyers already exist in the files of brokers, investment bankers and M&A specialist.

It’s also important for sellers to understand the difference between investment bankers and brokers, usually, it’s a matter of transaction size. Brokers often sell companies with revenues in the range of $2 million to $20 million, in some cases more. Investment bankers, by contrast are looking for much bigger deals, often with $25 million companies on the low end. Perhaps a better way to think of it: Business brokers are Main Street; investment bankers are Wall Street.

Most companies, then, will be looking for a broker. A good broker helping set up a match is as invaluable to an owner as an accounting firm has been. So it’s important, says Chad Peterson, of Peterson Acquisitions, to develop a relationship with a broker or M&A specialist long before you decide to sell. “Every year, that broker should inform you of what your business is worth,” Peterson said. “That broker will also know what the market is.” Too often, he said, owners will only call when they panic because there numbers are down and retirement is looming. “They say ‘help me sell,’ but I just ask, ‘shouldn’t you have called me three years ago when things were good?’ And what I hear is, “I wasn’t ready to sell.” You have to stay in contact with a broker regularly, every year.”

Those pros can do the screening needed to ensure that buyers have the necessary financial muscle to follow through, and that they have the sector-specific skills needed to take your company to another level. If philanthropy and civic engagement have been cornerstones of the way you run your company, those pros can make sure to sift through the field for buyers who share your values.

Doug Hubler, of Apex Business Advisors, says that advice will help frame your overall strategy and help define the outlines of a successful sale. “Build a team of advisers, including a business broker, attorney, accountant, and banker to set the business up to attract buyers,” Hubler said. “When the business is properly prepared, the broker can target the best buyers for the business. A seller going to market on their own risks not getting full value for their business, limiting their market opportunity, and inadvertently letting the world know that they are for sale.”

That last piece is especially important if clients or vendors sense that they are about to lose a valuable business connection; the risk is huge that they’ll make a business decision that won’t mesh with your efforts to boost the curb appeal of your operation. Keep in mind that there usually is, or should be more than one right buyer, said Ryan Sprott of Great Range Capital. “The right buyer for some is someone with the highest price. For others, it’s the one who will treat you’re your kids in the business right. In private equity, we like to see owners keep a percent of the business if they don’t want to leave completely. Whatever they’re trying to accomplish, the right buyer can satisfy. There are lots of variables to get to the right buyer.”

In the final analysis, Danford said, the only perfect fit is you.

“But it is important to remember that a buyer is looking forward, not backwards,” he said. “The world changes very quickly and what worked in the past probably won’t be perfect in the future. Ideally, you want someone to bring continuity for your employees and customers, but survival is crucial, too. They’ll face challenges you never faced, and they’ll need to adjust to survive. If you are lucky, you will find someone who honors the past while surviving in the future.”