HOME | ABOUT US | MEDIA KIT | CONTACT US | INQUIRE

HOME | ABOUT US | MEDIA KIT | CONTACT US | INQUIRE

Many people ask: “When is the best time to buy long-term care insurance (LTCi)?” The answer: “Now, if you can afford the premium on an on-going basis and don’t have higher priority needs.”

The amount of coverage today is relatively unimportant. Future coverage, when you’re likely to need care, is critical. As the cost of care will increase over time, your coverage should automatically increase annually, as explained last month.

The table shows that LTCi is like opening a bank account for your child/grandchild at their birth. You leverage compounding by starting it as soon as possible. With a $4500 initial monthly maximum compounding at a typical 3% annually, if you buy LTCi 40 years before you need it and draw full benefits for 5 years, the insurer pays $935,204.

If you buy the same LTCi 10 years later, the timing and cost of your care won’t change, but your insurance would pay only $695,880. You’d forfeit $240,000 of potential benefits.

|

Maximum Benefits ($4500/month; 3% compound; 5 years of benefits) |

|

|

When Purchased |

Total Benefits |

|

40 years before need |

$935,204 |

|

30 years before need |

$695,880 |

|

20 years before need |

$517,800 |

|

10 years before need |

$385,292 |

|

Never |

$0 |

As the table shows, the longer you wait, the more coverage you sacrifice. Waiting also increases the risk that you’ll never buy LTCi, thereby forfeiting all coverage.

Besides having less coverage if you wait, you’d also pay more each year! Does it make sense to wait, and pay a higher annual LTCi premium for much lower benefits?

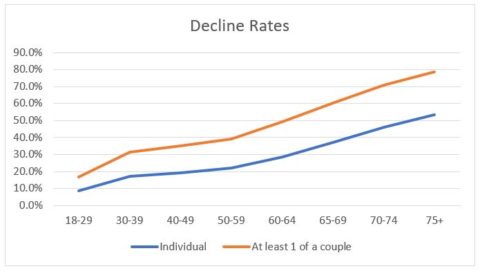

Furthermore, as the graph shows, if you wait, coverage for you, or your spouse, is more likely to be declined by the insurer. You can’t buy fire insurance when your house is burning and you can’t buy LTCi in poor health. You pay for LTCi with your money, but you buy it with your health.

The graph shows the risk of being declined accelerates more quickly after age 55. Some advisors suggest waiting until age 60 to buy LTCi, but at that age, there is a 50% chance that you or your spouse will be declined.

The older you are when you buy, you’re less likely to receive a “preferred health” discount that might save you 10%-20% forever and more likely to pay an additional 25%-50% because of a health condition.

Because couples’ discounts are available, it makes sense to purchase while married, even if your spouse doesn’t buy. Thus, it can make a lot of sense to buy LTCi prior to a divorce or spouse’s death.

If you have business income of any type, you can get nice tax breaks for buying LTCi. Buying earlier maximizes the number of years you get that tax break. (I am not a tax advisor. I share my understanding solely to help you determine whether tax issues might impact your decision regarding LTCi. If so, you should rely on the advice of a tax professional.)

For Missourians, your entire premium is tax-deductible on your Missouri income tax return. It makes sense to leverage that tax break as many years as possible, by starting early.

If you’d like to have LTCi, now is the best time to buy if you can afford it on an on-going basis and don’t have higher priority needs.

What questions would you like Claude to discuss? Submit them to ….

Ingram’s Long-Term Care expert, Claude Thau, a former inner-city schoolteacher and actuary, has helped employers, advisors and clients with LTC planning since 1994. He has written the most-read LTC insurance (LTCi) surveys annually since 2005, was named one of 10 “power people” in the industry by Senior Market Advisor in 2007 and helped develop the LTCi program for Federal government employees. He can be reached at 913-707-8863 or claude.thau@gmail.com. He created this website where you can privately study LTC and LTCi: www.usa-bga.com/claude-thau.