HOME | ABOUT US | MEDIA KIT | CONTACT US | INQUIRE

HOME | ABOUT US | MEDIA KIT | CONTACT US | INQUIRE

Federal Reserve Bank of Kansas City located at 1 Memorial Dr, Kansas City, MO. Photo: Google Maps

The former president and CEO of the Federal Reserve Bank of Kansas City, Esther George appeared on the American Century Investments webinar to address her thoughts on inflation trends plaguing the economy.

"The fact that the Fed has moved aggressively to get inflation under control, I think it raises the probability that something can break.”

On Wednesday, George made her first public speaking appearance since her retirement on The Policy Maker Next Door where she spoke on some apparent economic indicators that have caused the economy to lag behind as well as those leading in the right direction.

“Those things are looking at the unemployment rate… looking at inflation, there is nothing more important today to the Federal Reserve than understanding inflation dynamics, which are all lagging but its important to know what those trends are showing,” George said. “The leading indicators for example, how are markets thinking about inflation expectations, how are the survey of households around this country, how are people beginning to incorporate what they think inflation is going to do for the next year?”

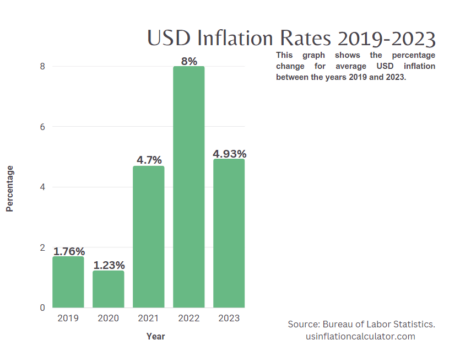

Graph: Canva

George goes on to point out how these trends have affected the economy in the past, believing inflation expectations are key to causing future inflation, she said.

Expectations can also lead to major fears in the economy and the threat of being thrust into a recession. George spoke about what factors are causing inflation to stay above trend.

“Factors have to do with demographics, they have to do with population trends in this country that have made our workforce particularly tight,” George said. “People left the workforce over the past three years and they have not yet come back, it’s not clear if they will come back giving the aging population and more people retiring and we are not bringing in the workforce we had before (pre-pandemic).”

When asked from the Federal Reserve’s perspective if a recession is the only cure for how the economy’s inflation has shifted, George said the probability is real, however, recession as a cure for inflation is ultimately more harm than good.

“When you look at today’s dynamics, certainly the Fed isn’t looking to put the economy in a recession, it would be counter to what the Fed needs to accomplish when bringing inflation down,” she said. “So you are always looking for the point at which you think the economy is coming into balance. That supply and demand dynamic is getting there but because that operates on lag it is very hard to see. I don’t think anyone on the FOMC wants that (recession). The fact that the Fed has moved aggressively to get inflation under control, I think it raises the probability that something can break.”

View the full webinar, here.

Posted June 8, 2023