HOME | ABOUT US | MEDIA KIT | CONTACT US | INQUIRE

HOME | ABOUT US | MEDIA KIT | CONTACT US | INQUIRE

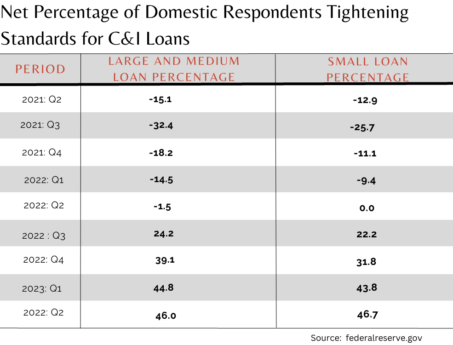

New data from the Federal Reserve Bank show a steep decline in business demand for commercial and industrial loans since interest rates began their sharp rise to combat inflation in the second quarter of 2022.

The Fed’s survey of lending officers shows that, for most of 2021 and the first quarter of 2022, the percentage of banks tightening loan standards fell sharply for big and mid-size companies, and to a lesser extent for small businesses. The third quarter of 2021 showed that trend at its ebb, with nearly a third of respondents saying they were not tightening standards for the larger borrowers, and one-fourth showing no tightening for small businesses.

Data from the Federal Reserve measuring supply and demand for C&I loans by the size of the firm seeking loans ranging from Q2 2021 to Q2 2023.

Graph: Canva

That trend did a 180 after flat-lining in Q2 2021. Since then, banks have consistently raised borrowing requirements for larger companies every quarter, starting with 24.2 percent in Q3, then to 39.1 percent, 44.8 percent and most recently, 46.0 percent. For small businesses, the trend line was 22.2 percent, 31.8 percent, 43.8 percent and 46.7 percent.

Between tightened access to capital and the costs of it as rates rose from near zero to the current Fed funds rate of 5.25 percent, demand from borrowers has tanked.

In all six quarters from Q2 2021 through the third quarter of last year, large-business demand for C&I loans increased, and small-business demand rose in five of those six.

The final quarter of 2022 painted a far bleaker picture: Larger-company demand has plunged—by 8.8 percent, 31.3 percent and a massive 55.6 percent over the past three quarters. Small business demand fell in that same time frame by 21.9 percent, 42.2 percent and, most recently, 53.3 percent.

You can read more about those banking trends in the full report.