HOME | ABOUT US | MEDIA KIT | CONTACT US | INQUIRE

HOME | ABOUT US | MEDIA KIT | CONTACT US | INQUIRE

June 2021

No. 1: Sethmar Transportation

No. 1: Sethmar TransportationGrowth: 1,645.34% | Average Annual Growth Rate: 548.45%

Gross Revenue: 2020: $29,670,807 | 2017: $1,700,000

Full-time employees: 31

Pictured (l-r): Sean Tully, Ben Galati, Ben Bolan, Matt Bolan, Brady Hissong

Celebrating 20 years in business, Sethmar Transportation is reaping the benefits of having put all the right pieces in place: vision, strategy, talent, processes, technology and, perhaps most important at this stage, as the fastest-growing company in the region, culture. “While we continue to grow, we have become more intentional about creating more structure to teams, numbers around individuals’ performance goals, training programs, and put more procedures in place we did not have a need for as a smaller company,” says CEO Ben Bolan. That means things like a company match on its 401(k) program, health-care benefits and, Bolan says, one of the most competitive commission plans in the logistics industry. “While we grow, there are a lot of opportunities for employees to advance their own careers if it interests them,” he says. Foundational to that success is effective communication. “One of the things we pride ourselves in is our transparent communication internally and externally to all our partners,” Bolan says. “We are a team, a family, we want to make sure every employee feels like they have a voice.” In 2020, while many companies were letting people go through furloughs, layoffs or outright job elimination, Sethmar was hiring in the middle of the pandemic. “We are expecting to be at 50-plus employees by the end of 2021 and are actively hiring,” Bolan says. “We aren’t looking to fill seats; instead, we are actively seeking the right people who will be a great addition to our family-friendly culture, hard-working and looking to build a rewarding career.” And who want to have a little fun while they’re at it. The company often caters in lunch, hosts beer Fridays and happy hours, stages giveaways as rewards for successful months. “We get to these goals,” Bolan says, “by being one team with the same drive.”

No. 2: Conexon

No. 2: ConexonGross Revenue: 2020: $30,660,764 | 2017: $1,907,572

Growth: 1,507.32% | Average Annual Growth Rate: 502.44%

Full-time employees: 178

Pictured (l-r): Front row: Jeff Fincannon, SVP OSP Construction; Abby Carere, SVP Sales, Marketing & Account Management; Michael Byrne, SVP Information Systems | Back row: Randy Klindt, Partner; Andy Burger, SVP Operations; Jonathan Chambers, Partner; Terie Hannay, SVP Telecommunications Services

The model is right, the timing is right. The prospects for growth are there. The only thing holding Conexon back—if you can call 500 percent annual growth the past four years “held back”—is labor. “Attracting talent in this market is probably our biggest challenge,” says CEO Randy Klindt. “We have over 50 positions open today. Also, moving to a big-company mentality is difficult for us, as we have been a very agile company. A second straight year at No. 2 on the CR100 ranking, Conexon works with rural electric cooperatives to bring fiber connections to homes in rural communities, providing end-to-end broadband deployment and operations support. “Broadband is now considered an essential service,” Klindt says. “What we have known for years has become evident to all: Rural areas need access to reliable affordable high-speed broadband service.” And looking ahead, he says, their odds of continued growth are good: “We anticipate the same pace of growth in the next 2-3 years that we have experienced in the past few years because of the focus on rural broadband.”

No. 3: Shinnova Solar

No. 3: Shinnova SolarGross Revenue: 2020: $11,111,176 | 2017: $785,000

Growth: 1,315.44% | Average Annual Growth Rate: 438.48%

Full-time employees: 42

Pictured (l-r): Gary Gilfry, CEO/Co-Owner; Jay Ray, CFO; Ethan Holtman, Operations Director; Jeremy Goeller, COO/Co-Owner

Everybody felt the pain of a global pandemic in his or her own way, but for Gary Gilfry and his team at Shinnova Solar, the numbers for 2020 are a study in What Might Have Been. In their case, a likely No. 1 finish in the Corporate Report 100 but for the leveling off of revenues at Shinnova Solar last year. Nonetheless, a third-place finish in one’s first year of eligibility isn’t too shabby. “We were expecting to double in 2020,” Gilfry says, and Shinnova had staffed up in anticipation of that. “Then March came. We could have done really well if we hadn’t hit COVID.” What sustained Shinnova, in large part, were the same elements that placed it on that trajectory in the first place: solid relationships with clients, vendors and engineering partners. The company provides a suite of all-inclusive custom energy solutions, including system design, solar panel installation and 24/7 real-time energy monitoring, all meant to help customers fend off the risk of higher energy rates and reduce their carbon footprint. With the metrics suggesting that the pandemic is behind us, Gilfry says the team is ready to reload. We’re going to reset and go back to where we were,” he declares.

No. 4: RE/MAX Infinity

No. 4: RE/MAX InfinityGross Revenue: 2020: $4,009,055 | 2017: $299,819

Growth: 1,237.16% | Average Annual Growth Rate: 412.39%

Full-time employees: 2

Pictured (l-r): Melani Peña, Director of Agent Services; John Ketchum, Owner;

Sydney West, Broker Liaison

Exponential growth in your first year, John Ketchum will tell you, “is easy. But the goal has always been the same—to grow with the right kinds of agents. If you fill your office with agents who value sales production, learning new things, and office culture, then they tend to attract more clients and more like-minded agents both.” From that comes the kind of growth that has propelled RE-MAX Infinity to 12-fold growth since 2017. Residential realty firms have prospered on a wave of demand in recent years, but none at the level of Ketchum’s agency. “Kansas City has always been a great place to live … Kansas Citians know that,” he says. “Only recently has there been a major influx of foreign (out-of-state and out-of-country) investment in our area because of the relatively inexpensive housing costs when compared to major metropolitan markets.” That, he says, was amplified during COVID-19 where employees found an even bigger importance to their homes and the spaces they occupy. And he’s confident more growth is to come: “As Silicon Valley has seen a mass exodus to markets such as Austin and Denver, Kansas City has and will continue to see significant influx in commercial and residential footings.”

No. 5: Summit Heating & Cooling

No. 5: Summit Heating & CoolingGross Revenue: 2020: $4,921,272 | 2017: $538,889

Growth: 813.23% | Average Annual Growth Rate: 271.08%

Full-time employees: 27

Top: Luis Zelaya, Service Manager; Debbie Williams, Projects Manager; Brendan Williams, Owner; Liz Williams, Owner; Bryan Russell, Installation Manager. Middle row: Cassie Lara, Office Manager; Christa McLaughlin, Customer Service Manager. Bottom row: Gym Lewis, Operations Manager

When Brendan and Liz Williams founded Summit Heating & Cooling in 2017, he says, they had “a specific business plan and go-to-market strategy that centers around high-quality internal customer service, meaning our co-workers. We take the best possible care of each other and create a culture that far supersedes other contractors in our area.” Can’t argue with the results, as the company rockets into a Top 10 CR100 slot in its first year of eligibility. It started with the purchase of Bob Mills Heating and Cooling in Liberty and the application of new processes. Next came key partnerships with Lowe’s and Lennox, as a premier dealer, then came additional acquisitions and a bigger retail presence through Costco. The only potential barrier to continued mega-growth is a challenge facing every company that touches the construction sector: Supply chain. Globally, it’s been a wreck since COVID-19 hit last year, limiting access to materials and driving up costs. “That’s the biggest thing,” Williams says. “Honestly, this year is looking more like a challenge to us than last year for that very reason.”

No. 6: Brain Group

No. 6: Brain GroupGross Revenue: 2020: $4,887,833 | 2017: $552,332

Growth: 784.95% | Average Annual Growth Rate: 261.65%

Full-time employees: 7

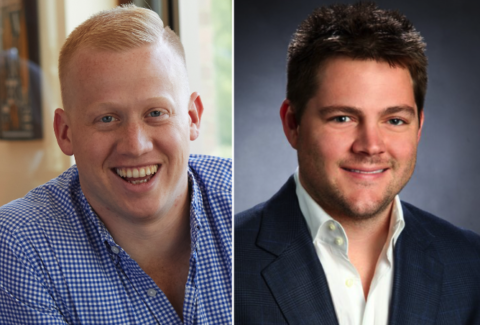

Pictured (l-r): Andrew Brain and Chad Sneed, Partners

The Brain Trust—yes, we said it—at the Brain Group comprises two up-and-coming realty pros on a mission: They see opportunity in identifying and giving new life to structures in the urban core that have outlived their original mission, purpose or useful life. Andrew Brain and Chad Sneed were both Ingram’s 20 in Their Twenties honorees in previous years, and for good reasons. Now, they’ve joined forces to identify unique and undervalued assets for repositioning and/or redevelopment. And in urban Kansas City, that’s what one might call a target-rich environment. With financial skin in the game on every project, they attract investors, then draw on their experience in developing, consulting, financial analytics, and asset management on every project. “We stay local ‘cause we know local,” they say, and their model seeks to identify projects that can effect true change in the redevelopment space. Per-haps the signature example of that philosophy has been the remaking of the Westport High School building into Plexpod Westport Commons, the world’s largest co-working studio when it opened several years ago.

No. 7: Tallgrass Freight

No. 7: Tallgrass FreightGross Revenue: 2020: $70,765,374 | 2017: $10,681,000

Growth: 562.54% | Average Annual Growth Rate: 187.51%

Full-time employees: 23

Pictured (l-r): Michael Hayes, VP-Product Development; Paul Roman, Sr. Finance Manager; Kayla Hall Johnson, Sr. Recruiting Manager; Todd Sanford, Sr. Collections Manager; Sean Richardson, VP-Growth and Development; Damon Anderson, Co-Owner/CEO; David Barnes, Co-Owner/COO; Mike Clemmons, VP-Operations; Chelsea Pike-VP Account Services

When Damon Anderson and David Barnes founded Tallgrass Freight in 2012, they were on the cusp of something big. Their Shawnee-based logistics company serving the trucking industry capitalized on Kansas City’s emergence as a center of excellence in distribution of goods nationwide. This time, though, an element of chance was involved as they held serve for a second straight Top 10 finish. “We had a great staff, a tenured staff that is used to dealing with rapid growth, and we have sales teams all over the country—people in 39 states now,” Barnes says. But where some in the sector were sunk by clients’ inability to pay for services amid the 2020 pandemic, he says, “we’ve been able to manage the bad-debt monster.” They remain poised to capitalize on growth opportunities, but with a cautious eye: “We’re the canary in the coal mine for this industry, the first to take a black eye,” Barnes says. “A lot will depend on what consumers do with $2 trillion in the bank. If everyone is buying tomahawk steaks and tickets to Disneyland, we might all be in trouble. But for now, we’re pedal to the metal.”

No. 8: Lead Bank

No. 8: Lead Bank Gross Revenue: 2020: $117,828,000 | 2017: $18,314,000

Growth: 543.38% | Average Annual Growth Rate: 181.13%

Full-time employees: 93

Nearly seven years ago, Lead Bank broke out of its traditional role as a small community bank, seeking to identify and serve national clients by building staff, operational technology, and compliance services in the area of electronic payments, says CEO Josh Rowland. The strategy has expanded to consumer-focused services, via fintech partnerships, for underserved consumers across the country. “Adding approximately 3,700 accounts per day, Lead Bank now serves over half a million consumers and businesses across the country,” Rowland says. Building a business in ways that community banks typically do not, he says, is not without challenges, especially in a competitive banking market like this. After the 2008 financial crisis, “we began investing in services, people, and technology, including robust compliance and risk management, to serve underserved markets for business and consumers. The urgency we felt was matched by the emergence of financial technologies and innovation which needed strong and nimble banking partners.”

No. 9: United Real Estate Group

No. 9: United Real Estate GroupGross Revenue: 2020: $256,913,732 | 2017: $44,680,000

Growth: 475.01% | Average Annual Growth Rate: 158.34%

Full-time employees: 167

For anyone who doubts that every company today is a tech company, look no further than United Real Estate Group. Explosive growth there in recent years, says CEO Dan Duffy, followed the company’s investment to build its own tech platform that would serve the agency’s own interests and those of brokers, leading to the launch of seven strategic-extension business units. “We took the core of what we do and extended it with similar products and services, and entered adjacent markets,” Duffy says. Every firm, he says, has certain core competencies that meet a market need, “but with a slight adjustment of your tools, sometimes even no adjust at all, you can open up entirely new markets.” For example, the company’s tools for licensed realty professionals were easily modified for use by auction services, a breakthrough into new markets there. That tech thrust, plus strategic acquisitions to enter new markets nationwide, lit the fuse. And it continues to burn, as Duffy says United is still in the process of assessing further acquisitions.

No. 10: Apollo Insurance Group

No. 10: Apollo Insurance GroupGross Revenue: 2020: $7,370,000 | 2017: $1,506,921

Growth: 389.08% | Average Annual Growth Rate: 129.69%

Full-time employees: 45

Anyone who has closely followed the Corporate Report 100 over the years knows that multiple Top 10 appearances can also be a red flag those unprepared to handle consistent growth at that scale. Do not count among those at-risk organizations Apollo Insurance Group, where Scott Eckley and the family are managing just fine. In this, the fifth straight CR100 appearance and its second in the Top 10 since debuting at No. 6 in 2017, Apollo is finding new growth barriers to break down. “The greatest challenge has been identifying the caliber and number of employees we have needed to keep up with our agent growth. So far so good!” Eckley declares. “We have truly been blessed with people who thoroughly enjoy coming to work every day. The economy was not necessarily an impediment for what we do.” Corralling that growth monster, he says, “starts with the leadership mentoring program we have, followed by relentlessly recruiting those people we believe possess the requisite character and personality traits to be successful at Apollo.” It’s working well so far, and should for the foreseeable future: “Right now,” Eckley says, “we are predicting in three years we will double in size again from where we are today.”