HOME | ABOUT US | MEDIA KIT | CONTACT US | INQUIRE

HOME | ABOUT US | MEDIA KIT | CONTACT US | INQUIRE

2nd Year

Growth: 949.83% Average Annual Growth Rate: 316.61%

Gross Revenue: 2014: $21,238,011 2011: $2,022,994

Full-time employees: 7

There’s a good reason why Norman Haas is passionate about being in the chocolate business—and it’s not just because every minute of his day, in some fashion, connects him with chocolate. “I’ve been selling imported bulk chocolate for over 31 years,” Haas says, “and have yet to experience any long-term downturn in that business.”

Quite the contrary over the past year. His company, Foodlinks, is the chocolate-covered cherry on top of this year’s Corporate 100 sundae, coming in at No. 1 with just shy of four-digit growth from 2011 to 2014. That’s a significant step up from the 454.71 percent increase that earned Foodlinks a No. 8 finish on last year’s list of the region’s fastest-growing companies.

“That market stability,” says Haas, “and the fact that it’s a product with so much cachet, has kept my interest in building a business around it.” The secret to the success of this company, founded in 2001, was partnering with a Columbian company to make world-class chocolate at the source of the cacao bean production, rather than paying to ship beans to Europe for processing. The launch of the company’s Colombian line, “Cordillera,” in 2004 took advantage of that local sourcing to make some of the world’s best chocolate. “We were able to produce chocolate as good or better than the finest from Europe, but at a significantly reduced price,” Haas says. “The fact that we can now deliver very high-end chocolate to customers throughout North America, at a price more affordable to them, is a source of tremendous satisfaction to me.”

Since last year, the company has diversified and spread out: “We have expanded our product line with a wider range of chocolate for the industrial and food-service markets,” Haas said. “In addition, we have launched a full line of non-GMO food ingredients catered to food manufacturers looking to capitalize on the ever-increasing demand for foods with no genetically modified organisms.”

Other success factors he cites are the ongoing financial support from the Bank of Blue Valley, and a business model that allows employees to work from home, which helps attract top talent, including company president Keith Cook.

A final edge came via the policy front. The free-trade agreement between the U.S. and Colombia, he said, “had a definite impact on our premium chocolate business, as we were no longer required to pay tariffs for several items. That impact on our overall business has lessened, however, with the addition of chocolates from Canada and Europe as well as the marked increase in sales of non-GMO ingredients.”

2nd year

Gross Revenue: 2014: $9,420,145 2011: $1,070,145

Growth: 780.27% Average Annual Growth Rate: 260.09%

Full-time employees: 17

After a valiant run at a repeat No. 1 finish—nobody’s done it yet in the 30-year history of the CR 100—Pendo Management Group weighs in at No. 2 this year under co-founders Jeff Sandman and Mike Peck.

The company offers appraisal services for residential and commercial properties, plus specialty appraisals for real estate-owned, reverse mortgages, relocations and other valuation service niches, all grounded in a fierce adherence to ever-changing compliance requirements.

Sandman and Peck formed the company in 2009 to capitalize on the real-estate sector’s rediscovered commitment to working with accurate property appraisals. The nation’s real-estate crash in 2008 was due in part to, shall we say, a certain kind of morally casual attitude regarding property values reported on millions of soon-to-be-foreclosed mortgages. But Sandman and Peck knew there would be a demand from mortgage lenders for business with reputable companies that could provide concierge-level service, combined with qualified appraisers—and they were right.

1st year

Gross Revenue: 2014: $12,065,450 2011: $1,445,311

Growth: 734.80% Average Annual Growth Rate: 244.93%

Full-time employees: 21

Historically, business startups have been the silver lining in the dark clouds of an economic downturn. Clint Spoor knows all about that.

In 2004, when times in construction were good, he was general manager at a local construction company. By 2011, it all came undone: No job, and no prospects. “While having coffee with the pastor of my church, he suggested that I start my own company,” Spoor recalls.

“I put together an LLC and went to work.” Thus was born Complete Construction Services, a Shawnee company that has leveraged Spoor’s experience as a project manager and executive to soar into the top tier of the region’s fastest-growing companies. How? “CCS is based on the concept of helping other people to build their dreams,” he says. “This has driven our values, vision and success. It is a simple concept, yet it has been the contributing factor in our success.” CCS’s services include general contracting, pre-construction services, design-build and construction management for retail, office and health-care settings.

2nd year

Gross Revenue: 2014: $32,033,000 2011: $4,740,000

Growth: 575.80% Average Annual Growth Rate: 191.93%

Full-time employees: 30

In some ways, it’s been a year of change at Fogel-Anderson. In one important way—growth—it’s been more of the same. Perhaps most significantly, the company went through an ownership buyout as Phil Bartolotta handed the reins over to a new, four-member ownership team. But it retains its ownership ties to the family; JoLynne Bartolotta is part of that ownership group, and she represents a fourth generation of the family to be connected with the company.

“The new ownership group brought a host of contacts into the business who had not done business with Fogel-Anderson in the past,” said Greg Harrelson, president. “Some of those were in segments which had not been accessed for some time, so the change not only increased the contacts available to the company but also in some previously untapped business segments.” That, plus a strong core of employees, he said, allowed the company to capitalize on recovery in that sector.

1st year

Gross Revenue: 2014: $3,338,285 2011: $577,625

Growth: 477.93% Average Annual Growth Rate: 159.31%

Full-time employees: 35

In this post-recession economy, the Kansas City area has seen strong numbers of IT companies plumbing various niches in that broad market, and exploited new opportunities to take their growth into hyperdrive. So it’s been with Solomon Consulting Group, which boasts expertise both from its in-house consultants working as project managers for clients, and with staffing solutions that include direct hire, contract work, or contract-to-hire.

The client base runs the gamut from start-up companies to Fortune 500 giants. “Being able to focus on a business intelligence niche within Kansas City and the surrounding areas has differentiated Solomon Consulting Group,” says President Grant Gordon. “Our team’s focus is to lead with the expertise we have built up since 2008 in the BI industry, and resulted in double-digit growth year after year.” Last year, it added key practice directors, giving the company access to all of the region’s major markets, he said.

2nd year

Gross Revenue: 2014: $6,901,714 2011: $1,360,642

Growth: 407.24% Average Annual Growth Rate: 135.75%

Full-time employees: 14

In the fiercely competitive world of online marketing, says Nathan Roberts, CEO of Avenue Link, you’d best be prepared for three challenges. “Competition, competition, competition,” he says. “Most of us are all seeking and striving for similar goals (more revenue), so working harder and smarter is our motto.

The goal is to automate as much as we can, so that our staff can come up with new ideas and solutions to an ever increasingly changing industry.” Avenue Link earned a second straight Top 10 finish by investing heavily in IT resources, he said, because it’s an absolute must given growth in advertising for both online and mobile devices. The focus now, Roberts says, is on adding strong talent “and not getting too sucked in to various opportunities. In the online space, there’s hundreds of opportunities popping up all the time, and it’s easy to be distracted with new ideas, but if you lose focus on the core business, your competitors may notice.”

2nd year

Gross Revenue: 2014: $4,455,915 2011: $892,497

Growth: 399.26% Average Annual Growth Rate: 133.09%

Full-time employees: 13

For Finkle + Williams Architecture, it’s all about substance, and not about flash. “We have always managed our firm conservatively,” says Greg Finkle, president the Overland Park firm. “We have never been leveraged or drawn on a line of credit to operate our business, which I believe allowed us to persevere during the difficult economic downturn that our industry (and many others) experienced a couple years ago.” More recent growth, he says, stemmed from the markets the firm serves, which seemed to rebound from the recession before others—particularly the industrial sector.

But the firm has also been open to evolving and growing as opportunities have presented themselves to expand into new markets, and, Finkle notes, “we have been quietly working overseas for the last decade or so. The fact that the world is now ‘flat’, working in different regional/global economies does have some advantages. If one region is distressed, another may be thriving.”

2nd year

Gross Revenue: 2014: $19,345,000 2011: $3,935,593

Growth: 391.54% Average Annual Growth Rate: 130.51%

Full-time employees: 9

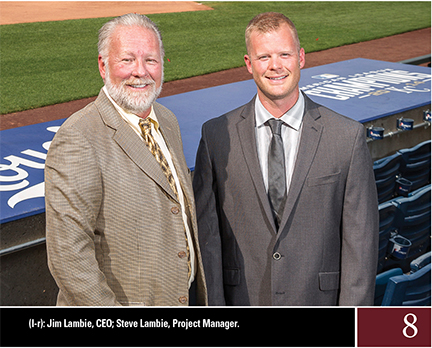

The first year was about roping the growth bronco. Making it bow to your will is what produces the consistency needed to score back-to-back Top 10 finishes in the CR 100. So here are broncbusters Jim Lambie and his crew at James Lambie Custom Homes, with a second straight appearance in this elite group.

Two factors outside of the company’s control proved crucial this past year, Lambie says: The economy, and low interest rates. But among the success factors the company does control are its four value pillars: Teamwork, Excellence, Achievement and Mutual Respect. Embracing each is key to survival in the highly competitive world of building upper-bracket homes in some of the metro area’s most exclusive residential subdivisions.

The company offers nearly three dozen floor plans, ranging from ranch to two-story, in more than 20 communities, including the upper-bracket Mills Farm Estates in Overland Park, where homes top out at $2 million.

1st year

Gross Revenue: 2014: $7,436,446 2011: $1,791,366

Growth: 315.13% Average Annual Growth Rate: 105.04%

Full-time employees: 12

Geography. Focus. Technology. Culture. Those are the four growth factors at American Consultants, a health-care staffing company based in Overland Park. It’s not a start-up gazelle; the company has been around since 1989, but things really took off in 2014, when revenues more than tripled.

One reason, the company says, was because of a geographic expansion to provide staffing services nationwide.

Second was the effort to hone the specialization to the ranks of executives, health-care IT professionals, laboratory specialists and advanced practitioners, then began recruiting experts in those areas. The tech piece came with a savvy use of social media marketing to connect health-care organizations and professionals with a growing client and candidate database.

And finally, the company made a concerted effort to establish a culture of teamwork. “Every member of our team,” says Tiffany Williams, the company’s marketing and business development coordinator, “is always willing to contribute, driving our overall success”.

1st year

Gross Revenue: 2014: $8,323,293 2011: $2,099,970

Growth: 296.35% Average Annual Growth Rate: 98.78%

Full-time employees: 91

The period from 2011 to 2014 may have been one of the best ever to be in the multifamily housing sector, whether you were in it as a developer, as a builder or as an investor. In the wake of the preceding recession and real-estate crash, more Americans had become disillusioned with the diminishing value proposition of home ownership. Result? Demand for quality apartments soared, as did construction.

Riverside-based Worcester Investments, founded just ahead of the real-estate bust of 2008, was well-positioned to capitalize on that trend: It now has interests in 17 apartment communities on either side of the state line. “We have the ability to see beyond the current status of an asset and plan for a better future, allowing us to continue to grow

by acquiring additional apartment communities,” says CEO Julie Still.

The family-owned company specializes in full-service property management, including leasing, accounting, collections, maintenance and rehabilitation of apartment communities.

4th year

Growth: 290.74% Average Annual Growth Rate: 98.78%

Gross Revenue: 2014: $67,750,000 2011: $17,338,832

Full-time employees: 54

This family-owned construction company, today co-administered by its third generation, has been at the forefront of the Kansas City area’s multifamily residential building boom. And they’re doing it across the entire scope of this metropolitan area, with projects ranging from southern Johnson and western Wyandotte County to Lee’s Summit, the Northland and Downtown Kansas City.

1st year

Growth: 290.23% Average Annual Growth Rate: 96.74%

Gross Revenue: 2014: $1,191,172 2011: $305,250

Full-time employees: 10

Chrys Sullivan founded this Westport-based IT company in 2008 to provide research, design and development services to clients in a wide range of business sectors and sizes. Those range from Hallmark, H&R Block and 3M down to local names like Ascend Learning and Purple Wave, the online auction firm.

2nd year

Growth: 278.03% Average Annual Growth Rate: 92.68%

Gross Revenue: 2014: $67,603,347 2011: $17,883,138

Full-time employees: 49

Since taking the plunge in 2010—as the rest of the construction sector was cratering—the leadership triumvirate of Courtney Kounkel, Richard Wetzel and Steve Swanson has had this thriving startup on an impressive growth curve. Centric’s new model for commercial construction delivery, Wetzel says, helped account for its growth, which included a doubling of year-over-year revenues in 2014 alone.

9th year

Growth: 276.19% Average Annual Growth Rate: 92.06%

Gross Revenue: 2014: $21,516,389 2011: $5,719,600

Full-time employees: 80

For 18 years, Mike Wrenn and his crew have been fixtures on the CR100, first with nine appearances as Wrenn Insurance, and more recently as Affinity Group Management, which ties that previous Wrenn mark this year. Affinity offers insurance services that cover investor-owned multi-family housing units and commercial properties coast-to-coast.

1st year

Growth: 271.21% Average Annual Growth Rate: 90.40%

Gross Revenue: 2014: $15,771,001 2011: $4,248,526

Full-time employees: 7

When they talk about the housing sector limping along, they’re overlooking the slice of it that’s made up of luxury homes, and the folks at J.S. Robinson have been taking advantage of continued strength in that segment. The company has built more than 1,200 homes in some of Johnson County’s most affluent areas over the course of more than 25 years.

1st year

Growth: 242.00% Average Annual Growth Rate: 80.67%

Gross Revenue: 2014: $22,995,342 2011: $6,723,865

Full-time employees: 32

Effectively demonstrating that the Best Companies to Work For can also be among the fastest-growing—no rocket science involved in that calculation—Tim Harmon’s Olathe-based construction company continues to climb. The commercial contracting specialist builds health-care and senior living facilities, churches and commercial and industrial buildings.

11th year

Growth: 239.41% Average Annual Growth Rate: 79.80%

Gross Revenue: 2014: $28,975,342 2011: $8,537,004

Full-time employees: 57

When the going gets tough—as it did in 2011—the tough don’t just get going, they diversify, adapt to changing conditions in the marketplace, and tap into an entrepreneurial culture that will identify and seize new opportunities. For this civil engineering firm based in Overland Park, all of those factors have played a role in a strong rebound.

3rd year

Growth: 226.08% Average Annual Growth Rate: 75.36%

Gross Revenue: 2014: $246,520,000 2011: $75,600,000

Full-time employees: 4,500

Acquisitions and America’s unwavering appetite for fast food have been behind the rapid rise of KBP Foods, which operates 227 KFC, Taco Bell and Long John Silver’s restaurants in 20 states in the Midwest and Southeast U.S. And with the buyout of its private equity owners earlier this year, more growth is forecast for the Overland Park company.

2nd year

Growth: 209.88% Average Annual Growth Rate: 69.96%

Gross Revenue: 2014: $11,685,445 2011: $3,770,908

Full-time employees: 45

Changes in the post-recession value proposition of home ownership have triggered explosive growth in multi-family housing. From that have come opportunities that Axiom co-founders John Emanuels and Ben Kalny have exploited by assembling investment groups to buy and optimize apartment complexes. High-quality associates and high-level service, they say, have combined with acquisitions to keep the growth strong.

8th year

Growth: 208.17% Average Annual Growth Rate: 69.39%

Gross Revenue: 2014: $29,400,000 2011: $9,540,084

Full-time employees: 106

A two-tiered approach to IT staffing—both as a staffing firm and with a consulting staff of more than 180 IT experts—has kept ECCO Select on a muscular upward arc for two decades. Now with nearly 200 employees, roughly divided between Kansas City and the nation’s capital, the Northland company offers its services to government offices and corporate clients in a wide range of sectors.

4th year

Growth: 204.12% Average Annual Growth Rate: 68.04%

Gross Revenue: 2014: $11,954,287 2011: $3,930,789

Full-time employees: 10

Scott DeNeve took the plunge with business ownership in 2005, and despite what’s happened in the housing sector since then, his Platinum Realty has done nothing but perform. His model—tech-savvy, low-overhead, with higher commissions for realty pros—has fueled an expansion that has outgrown the metro market: Earlier this year, the company opened an office in St. Louis.

5th year

Growth: 194.54% Average Annual Growth Rate: 64.85%

Gross Revenue: 2014: $5,732,000,000 2011: $1,946,053,546

Full-time employees: 860

Providing financial services to customers in all 50 states, this century-old Topeka company has evolved from its roots in the insurance sector into an investment behemoth, with more than $26 billion in assets under management. The hugely successful launch of its SE2 subsidiary in 2005 has helped fuel stellar growth, offering business technology and processing solutions for financial services and insurance companies.

3rd year

Growth: 180.84% Average Annual Growth Rate: 60.28%

Gross Revenue: 2014: $117,061,836 2011: $41,682,369

Full-time employees: 24

Tracing its roots to 1887, this Lenexa company now includes a fifth generation of the Smith family in its mission as a full-services commercial contractor. It offers general contracting, construction management and preconstruction services, along with construction forensics, and primarily builds schools, health-care, correctional and municipal facilities.

1st year

Growth: 176.11% Average Annual Growth Rate: 58.70%

Gross Revenue: 2014: $11,671,856 2011: $4,227,248

Full-time employees: 53

Kansas City’s growing reputation as a center for life sciences research is due in part to the support it gets from companies like KCAS, which provides bioanalysis for preclinical and clinical studies. The company, based in Shawnee, was founded in 1979 and since 2011 has been led by CEO Terry Osborn.

4th year

Growth: 171.92% Average Annual Growth Rate: 57.31%

Gross Revenue: 2014: $64,698,254 2011: $23,792,971

Full-time employees: 42

Chalk up another solid performance from this Lee’s Summit home builder. Owner Fred Delibero has built a company known not just for producing stunning homes, but as a philanthropic force (for years, Summit has been the contractor for the annual St. Jude Hospital home raffle), as well as one known for its emphasis on sustainability.

3rd year

Growth: 169.81% Average Annual Growth Rate: 56.60%

Gross Revenue: 2014: $5,042,294 2011: $1,868,803

Full-time employees: 28

Recent years have seen both a low-interest rate environment and at least a partial recovery in home values, compelling fence-sitters to get in the home ownership game. Founder Ryan Wiebe and his team of lending consultants have capitalized on that demand, adding new markets, sharpening marketing strategies throughout its eight-state reach, and focusing on staff development.

4th year

Growth: 167.66% Average Annual Growth Rate: 55.89%

Gross Revenue: 2014: $46,931,000 2011: $17,533,500

Full-time employees: 25

Lenora Payne has lived out every entrepreneur’s dream since forming Technology Group Solutions as a small start-up a decade ago, turning it into a power player among IT services companies. TGS is certified as a minority-owned and woman-owned business offering managed and professional services, business solutions and technology assessment.

2nd year

Growth: 167.13% Average Annual Growth Rate: 55.71%

Gross Revenue: 2014: $29,216,723 2011: $10,937,273

Full-time employees: 14

Family owned for three generations, this Olathe-based home builder has found its sweet spot with houses that hit the market in the range of $180,000 to $400,000. With nearly 2,000 abodes to its credit since the company’s founding, it has homes in 14 housing developments that span either side of K-7 in western Johnson County.

2nd year

Growth: 161.22% Average Annual Growth Rate: 53.74%

Gross Revenue: 2014: $1,909,169 2011: $730,880

Full-time employees: 14

From quad-cab trucks to small unibody frames, Warrensburg Collision has the mechanical muscle to handle most any vehicle repair job. It offers free estimates, a drive-through estimate service and customer reception area, and combines mechanical know-how with efficiency and technological advances to put customers back on the road in near-new shape.

1st year

Growth: 160.80% Average Annual Growth Rate: 53.60%

Gross Revenue: 2014: $31,259,000 2011: $11,986,000

Full-time employees: 75

United Real Estate Group boasts a pair of realty brands—United Real Estate and United Country Real Estate—and is a fully integrated network of conventional and auction real-estate professionals. Serving more than two dozen markets, it can accommodate first-time buyers, empty-nesters looking to downsize, investors in foreclosed properties and more.

3rd year

Growth: 156.11% Average Annual Growth Rate: 52.04%

Gross Revenue: 2014: $46,254,160 2011: $18,060,323

Full-time employees: 436

Jeff Hargroves founded ProPharma Group in 2001 to offer validation services to clients in the pharmaceutical, biotechnology and medical-device sectors, and within five years, his company was operating not just in Kansas City, but on both coasts. It has since grown to encompass a wide range of services in compliance, quality assurance and IT fields.

6th year

Growth: 152.44% Average Annual Growth Rate: 50.81%

Gross Revenue: 2014: $22,667,312 2011: $8,979,287

Full-time employees: 35

If it’s a corporate incentive, Tom and Carol Barnett probably have their hands on it; they’ve been at the vanguard of a booming fulfillment business for more than three decades. Mid-America Merchandising has grown from a small merchandiser serving outlets like banks and credit unions, and now specializes in fulfillment as well as decorating and distribution services.

2nd year

Growth: 150.70% Average Annual Growth Rate: 50.23%

Gross Revenue: 2014: $14,334,962 2011: $5,718,000

Full-time employees: 67

This award-winning design firm, founded in 1950 and now co-led by John Southard and Kirk Horner, enjoyed record revenues in 2014. The firm does a considerable volume of work with universities and public school districts. It provides master planning, architecture and design, interior design, structural engineering and architectural environmental graphic design services.

2nd year

Growth: 147.72% Average Annual Growth Rate: 49.24%

Gross Revenue: 2014: $40,620,000 2011: $16,397,590

Full-time employees: 54

Brand recognition is always a good thing, but to get it, you have to do the hard work of recruiting clients at the grass-roots level, then deliver on promises you make to them. In the burgeoning regional logistics sector, D&L has done just that, providing freight-brokerage services for truckload, less-than-truckload and rail/intermodal shipments in the U.S. and Canada.

2nd year

Growth: 145.43% Average Annual Growth Rate: 48.48%

Gross Revenue: 2014: $40,791,000 2011: $16,620,000

Full-time employees: 120

It took a particular kind of banking vision—and nerves of steel—to open a bank in 2007, as the nation was wracked with recession. But since making that bold move, CrossFirst Bank has leveraged its low-cost model into monster growth in its asset base, and is now among the region’s billion-dollar club in that regard. Mike Maddox is the CEO of this Overland Park-based bank.

3rd year

Growth: 139.70% Average Annual Growth Rate: 46.57%

Gross Revenue: 2014: $3,793,616 2011: $1,582,666

Full-time employees: 10

Que? Como? Shto? If you have to ask, maybe you need a better translation service, and that’s just what Propio Language Services provides. The Lenexa-based company’s staff of translators and interpreters are at ease with a dizzying array of more than 200 languages, offering those skills to private and government clients.

2nd year

Growth: 135.02% Average Annual Growth Rate: 45.01%

Gross Revenue: 2014: $16,245,018 2011: $6,912,147

Full-time employees: 33

More than 20 years after Joan Wells and Jada Hills founded this company specializing in corporate events and gifting strategies, Wellington has emerged as an events planning firm with a laser focus on supporting client brands. The company grounds its own success in four pillars: brand curation, signature experiences, industry innovation and inventive gift solutions.

2nd year

Growth: 125.12% Average Annual Growth Rate: 41.71%

Gross Revenue: 2014: $7,173,080 2011: $3,186,291

Full-time employees: 44

The more America’s economy becomes reliant on home delivery of products formerly acquired at retail stores, the more chances there are that a shipment goes wrong—and a shipper has to pay. That’s the problem VeriShip stepped in to address with both data and diagnostics, and 3,000 shipping clients later, the company is riding high—as are the shippers who have cut costs with VeriShip’s assistance.

3rd year

Growth: 120.13% Average Annual Growth Rate: 40.04%

Gross Revenue: 2014: $105,000,000 2011: $47,700,000

Full-time employees: 150

Astute readers will note a surprising number of home builders represented this year. And if they’re walking the process back one step, they’re not surprised to see McCray Lumber and Millwork on the fast-growth track. After a steep decline with the crash of the housing sector, the Overland Park company returns to nine-figures, supplying lumber and custom millwork to builders, remodelers and homeowners.

6th year

Growth: 119.84% Average Annual Growth Rate: 39.95%

Gross Revenue: 2014: $68,500,000 2011: $31,159,000

Full-time employees: 50

Just about everything that comes from a restaurant besides the food is likely to come from Regal Distributing, a Lenexa company that supplies the goods that restaurants need to deliver their own products: Take-home containers, plastic utensils, cups, lids, napkins and more. It also serves hospitals and other large institutional clients, and offers cleaning systems and supplies, as well.

3rd year

Growth: 119.12% Average Annual Growth Rate: 39.71%

Gross Revenue: 2014: $61,930,139 2011: $28,263,739

Full-time employees: 19

In Johnson County, the name Rodrock is synonymous with home construction, and this operation run by Brian Rodrock is one reason why: The company’s homes are available in 15 organized housing developments, and can be ordered in other communities, as well. Typically from $300,000 to more than $400,000 in cost, the company primarily works at sites in Overland Park, Olathe, Shawnee and Lenexa.

2nd year

Growth: 118.37% Average Annual Growth Rate: 39.46%

Gross Revenue: 2014: $1,652,680 2011: $756,825

Full-time employees: 18

Repeat clients, referrals and a strong reputation throughout the asset-management sector have been the keys to this Merriam-based firm’s success. The company specializes in professional physical inventory of fixed assets personal property and major moveable equipment in various settings, including health-care facilities, educational institutions, corporate clients and government offices.

3rd year

Growth: 113.86% Average Annual Growth Rate: 37.95%

Gross Revenue: 2014: $1,695,977 2011: $793,015

Full-time employees: 8

You pay to insure your home; doesn’t it make sense to insure the systems that run it? That’s at the heart of the value proposition at Complete Appliance Protection. The Liberty-based company offers policies that safeguard homeowners against the costs of replacing operating systems, appliances and other hardware that makes a house a home.

10th year

Growth: 111.64% Average Annual Growth Rate: 37.21%

Gross Revenue: 2014: $89,100,000 2011: $42,100,000

Full-time employees: 327

Wealth managers in the Kansas City region have made a splash on the nationwide scene in recent years, and the first ripples of that came with the rise of The Mutual Fund Store, founded 20 years ago with an innovative approach that helped democratize investing. It now has offices nationwide, staffed by teams of advisers who provide individually tailored investment guidance for individual clients.

1st year

Growth: 106.83% Average Annual Growth Rate: 35.61%

Gross Revenue: 2014: $25,400,000 2011: $12,280,700

Full-time employees: 176

More than doubling its size since 2011, Cretcher Heartland specializes in commercial and personal risk-management services, including commercial insurance, employee benefits, medical malpractice insurance and human-capital consulting. Its recent merger with the Power Group, says CEO Steve Nicholson, will add market share and greater client diversity.

14th year

Growth: 105.83% Average Annual Growth Rate: 35.28%

Gross Revenue: 2014: $2,470,000,000 2011: $1,200,000,000

Full-time employees: 3,425

Time was, Burns & McDonnell fit neatly into the category of engineering firms. Today, its explosive growth is tied to an equally impressive increase in the types of construction-related services offered by this south Kansas City firm. If you can envision any infrastructural work, the firm is engaged in it, from air-quality and power systems to transportation like bridges and airports, to municipal water systems.

1st year

Growth: 105.00% Average Annual Growth Rate: 35.00%

Gross Revenue: 2014: $7,995,000 2011: $3,900,000

Full-time employees: 36

Larger banks have come to embrace what they call community banking, and regulatory policy has tilted an uneven playing field even further away from the community banks in recent years. Despite those challenges, Great American Bank, with five locations from Lawrence to Lake Lotawana, has bucked the trend of many smaller institutions to post strong growth numbers.

10th year

Growth: 104.19% Average Annual Growth Rate: 34.73%

Gross Revenue: 2014: $22,061,819 2011: $10,804,638

Full-time employees: 166

DEG’s clients comprise a roster of regional, national and global brands, and when they hit their goals, DEG itself thrives. That’s been the case since its founding in 1999, as it has expanded to offer data-driven marketing, commerce and collaboration strategies for those client organizations, in the form of digital direct-marketing, eCRM, social media and other services.

4th year

Growth: 103.44% Average Annual Growth Rate: 34.48%

Gross Revenue: 2014: $54,493,403 2011: $26,786,122

Full-time employees: DD

More than 4 million components from more than 700 suppliers. So, yeah, if you’re in need of custom heaters, LED lighting, electrical assemblies and the like, Heatron is probably supplying it. The Leavenworth-based company designs, manufactures and distributes custom-engineered components for original equipment manufacturers nationwide.

3rd year

Growth: 101.27% Average Annual Growth Rate: 33.76%

Gross Revenue: 2014: $144,912,000 2011: $72,000,000

Full-time employees: 764

It wouldn’t be wrong to say that Joe Suhor’s success has been built on a foundation of concrete: As in burial vaults, precast concrete for storm shelters, retaining walls and wastewater systems, even concrete-based memorials. The latest phase in his companies growth was the recent merger with and rebranding under the Wilbert Funeral Services flag. The company remains based in Overland Park.

8th year

Growth: 97.72% Average Annual Growth Rate: 32.57%

Gross Revenue: 2014: $76,806,901 2011: $38,846,796

Full-time employees: 460

It took Faruk Capan six years to get his niche-marketing brainchild to $4 million in annual revenue, back in 2005. These days, Intouch Solutions is growing in chunks that big roughly every four months. His Overland Park-based firm provides marketing services for the pharmaceutical sector, and has been one of the biggest job-generators in the region in recent years, adding more than 300 positions.

3rd year

Growth: 92.85% Average Annual Growth Rate: 30.95%

Gross Revenue: 2014: $6,501,365 2011: $3,371,287

Full-time employees: 35

Whether it entails foundation repair, mud jacking and mending broken concrete, the company operating as Pier Masters and Master Mudjackers addresses issues of foundation settling, buckling walls, cracking, waterproofing and other structural needs. Founded in 1985, it operates from offices in Overland Park and Olathe, and its base in Grandview.

3rd year

Growth: 83.95% Average Annual Growth Rate: 27.98%

Gross Revenue: 2014: $2,078,621 2011: $1,130,000

Full-time employees: 12

The great thing about an innovative infection-control system like Hepacart’s is that your target market isn’t just the hospital—there’s a need for systems anywhere you find dust, debris and airborne contaminants. And a growing international clientele is one reason why Merriam-based Hepacart is thriving with its blend of infection-control barriers, dust containment equipment and installation solutions.

5th year

Growth: 83.90% Average Annual Growth Rate: 27.97%

Gross Revenue: 2014: $65,100,000 2011: $35,400,000

Full-time employees: 360

Joe Melookaran founded JMA in 1994, not long after the rest of us were introduced to something called the Internet. And like the rest of the IT sector over the past two decades, the company has been growing and evolving at the same time. The Overland Park company primarily serves small and mid-size businesses and public sector clients, providing IT and staffing solutions.

1st year

Growth: 83.25% Average Annual Growth Rate: 27.75%

Gross Revenue: 2014: $16,528,000 2011: $9,019,355

Full-time employees: DD

Educational institutions are all about instruction, but they have a lot to learn about how technology can drive engagement between the constituents. That’s where iModules steps in, providing services to manage Web sites and events, improve on-line giving and social networking or e-mail marketing. Since 2002, it has grown to serve 800 clients that have an aggregate 100 million constituents among them.

4th year

Growth: 80.67% Average Annual Growth Rate: 26.89%

Gross Revenue: 2014: $512,845,000 2011: $283,855,000

Full-time employees: 1,300

From a small plumbing supply operation started in the midst of the Great Depression, MMC Corp. has grown into a multifaceted company with four operating units specializing in mechanical contracting, general contracting, HVAC systems, solar power systems and more. The key to reaching that point, officials say, has been retaining that entrepreneurial spirit that marked its founding in 1932.

8th year

Growth: 78.39% Average Annual Growth Rate: 26.13%

Gross Revenue: 2014: $4,240,000 2011: $2,376,854

Full-time employees: 11

Wirehouse traders, in the end, work for the wirehouses, not the investors. That disconnect spawned the launch of the Retirement Planning Group, which is focused on helping individuals make their Golden years more golden. It’s latest foray into that mission, known as Bloom, provides a free 401(k) analysis for clients.

10th year

Growth: 76.71% Average Annual Growth Rate: 25.57%

Gross Revenue: 2014: $13,946,923 2011: $7,892,504

Full-time employees: 88

The top line, like the company’s name, keeps growing as its list of services for homeowners continues to grow at Bob Hamilton Plumbing, Heating, Air Conditioning and Rooter. For this family business based in Lenexa, the keys to growth have been superior customer service, retention of those customers, and improvements in process-oriented communication.

1st year

Growth: 76.57% Average Annual Growth Rate: 25.52%

Gross Revenue: 2014: $10,872,547 2011: $6,157,658

Full-time employees: DD

Founded in 2004 by John Nohe, JNA Advertising is a full-service advertising agency based in Overland Park. Its expertise in branding, interactive on-line design, media strategy, video/photography, copywriting, art design and other key functions are part of a comprehensive team approach meant to help clients drive the right message to the right consumers.

2nd year

Growth: 72.99% Average Annual Growth Rate: 24.33%

Gross Revenue: 2014: $3,346,523 2011: $1,934,540

Full-time employees: 12

In wealth management, past performance may not be an indicator of the future—but a clue if you’re looking for a successful firm. “We made good decisions for asset allocation,” says CEO Mindy Corporon. As a result, “clients refer us business.” The OP firm, which she co-founded with Richard Boyer in 2007, provides wealth management and services in financial planning, portfolio analysis and asset allocation.

3rd year

Growth: 71.45% Average Annual Growth Rate: 23.82%

Gross Revenue: 2014: $15,509,844 2011: $9,046,174

Full-time employees: 96

Founded in 1997 by three entrepreneurs with experience in wireless communications, SSC has built on its expertise in that field to expand and diversify its range of services. Today, it offers guidance in site acquisition, engineering, construction and project management, architectural services and more. The firm is also focused on renewable energy and infrastructure security.

3rd year

Growth: 70.64% Average Annual Growth Rate: 23.55%

Gross Revenue: 2014: $186,000,000 2011: $109,000,000

Full-time employees: 802

The company had hit something of a midlife crisis when Mike Valentine became CEO in 2010, but he has infused within it a blend of focused innovation and entrepreneurship to kick-start strong growth. Netsmart provides health-care IT systems for clients in behavioral health settings, an area that accounts for roughly 10 percent of U.S. spending on health care.

3rd year

Growth: 69.69% Average Annual Growth Rate: 23.23%

Gross Revenue: 2014: $21,575,952 2011: $12,714,611

Full-time employees: 26

As a company specializing in transporting trucks—the biggest ones—Jim Marmon’s team of two dozen employees continues to turn in strong numbers, crossing the $20 million revenue mark after less than a decade in business. The company offers services in transporting semis, dump trucks and other large vehicles, across the U.S. and Canada.

13th year

Growth: 67.56% Average Annual Growth Rate: 22.52%

Gross Revenue: 2014: $474,740,000 2011: $283,330,000

Full-time employees: 1,028

With offices in the U.S., Europe and Asia, this public company, based in Kansas City, Kan., specializes in systems to help law firms worldwide manage electronic discovery, bankruptcy cases and class actions, typically some of the most document-intensive types of legal affairs. Tom Olofson is the chief executive officer.

11th year

Growth: 67.25% Average Annual Growth Rate: 22.42%

Gross Revenue: 2014: $246,520,000 2011: $147,397,791

Full-time employees: 613

From an office of three people at its founding in 1984, CRB has grown into a multifaceted company offering expertise in engineering, construction, architecture, project management, consulting and more, and it now has more than 750 people working from its 14 locations nationwide. Its expertise in biopharmaceutical design has reached around the world, with projects in 22 nations.

3rd year

Growth: 66.33% Average Annual Growth Rate: 22.11%

Gross Revenue: 2014: $63,157,080 2011: $37,970,807

Full-time employees: 24

Solid referrals, superior products and first-rate customer service have proven to be a winning formula for James Engle Custom Homes. The Johnson County-based builder offers a wide variety of residential options, with more than 50 floor plans in models that range in price from $276,000 to more than $600,000.

5th year

Growth: 65.50% Average Annual Growth Rate: 21.83%

Gross Revenue: 2014: $73,968,000 2011: $44,694,000

Full-time employees: 397

With offices from Texas to Montana and North Dakota, this engineering design and technology-services company operates far afield from its home in Topeka. Led by Keith Warta, the firm provides an impressive array of engineering services, covering water, power and transportation infrastructure. Growth, the firm says, flows from a combination of increased service offerings and innovation.

1st year

Growth: 65.40% Average Annual Growth Rate: 21.80%

Gross Revenue: 2014: $1,401,275 2011: $847,225

Full-time employees: 5

Successful financial planning entails performance that satisfies a client’s investment needs, but there’s another factor that’s key to success: The underlying relationship with each client. And relationship-building, along with more efficient processes and service, have been a winning formula for Lighthouse since its 2007 founding, says CEO Jim Guyot.

3rd year

Growth: 61.71% Average Annual Growth Rate: 20.57%

Gross Revenue: 2014: $43,694,554 2011: $27,020,386

Full-time employees: 400

At some point, the startup becomes more than a one-man show, and moving to the next level requires more than extra hands—shared values are a must. At mortgage lender LeaderOne Financial, president and CEO A.W. Pickel III says “We grew by identifying and recruiting the right managers who know how and demonstrate caring for people.”

7th year

Growth: 60.72% Average Annual Growth Rate: 20.24%

Gross Revenue: 2014: $427,476,843 2011: $265,984,058

Full-time employees: 243

You don’t need tea leaves to read the growth story at Midway Ford Truck Center: A motivated staff of employee owners, a sales force of seasoned pros who forge relationships for the long-term, target markets heavily tilted toward fleet purchases, and a product line from iconic names in truck manufacturing. It all adds up to a fourth straight appearance, and eighth overall, for the Northland company.

11th year

Growth: 59.19% Average Annual Growth Rate: 19.73%

Gross Revenue: 2014: $112,174,347 2011: $70,465,728

Full-time employees: 450

It’s not just growth at City Wide, it’s growth on a big stage: Under the direction of CEO Jeff Oddo, the building-services company with franchises nationwide joined the region’s roster of $100 million-plus in revenues last year. City Wide provides a wide range of building interior and exterior maintenance and management services.

2nd year

Growth: 58.61% Average Annual Growth Rate: 19.54%

Gross Revenue: 2014: $105,000,000 2011: $66,200,000

Full-time employees: 265

Taylor Forge provides the mechanical muscle behind many key industrial sectors, designing, fabricating and installing complex pressure-control systems for companies like those in the energy, chemical and nuclear sectors and other heavy manufacturing settings. Paola-based but global in scope, it operates facilities in Greeley and Garnett, Kan., and in Tulsa.

4th year

Growth: 57.41% Average Annual Growth Rate: 19.14%

Gross Revenue: 2014: $6,965,683 2011: $4,425,099

Full-time employees: 59

Sometimes, the right product or service just keeps selling itself. With 11 physicians and nearly 50 other health-care professionals and support staff, Priority Care Pediatrics is there. “We have continued to be blessed by the ‘mommy network’ of patient/parent referrals, as all growth is without advertising,” says Alan Grimes, the physician who serves as managing member.

3rd year

Growth: 57.37% Average Annual Growth Rate: 19.12%

Gross Revenue: 2014: $1,458,200,000 2011: $926,60,000

Full-time employees: 217

Before turning the CEO’s chair over to Chris Concannon in March, founding executive Joe Ratterman orchestrated the 2014 merger with Direct Edge. That union has propelled BATS past NASDAQ and into its current position as the nation’s second-largest equities-trading platform, nipping at the heels of the venerable New York Stock Exchange.

3rd year

Growth: 57.07% Average Annual Growth Rate: 19.02%

Gross Revenue: 2014: $289,000,000 2011: $184,000,000

Full-time employees: 1,279

Surging 25 spots on the CR100 after making just its second appearance a year ago, Olathe-based D.H. Pace specializes in home, office and industrial door sales, installation and service. But the company, under CEO Rex Newcomer, does a lot more than doors; it also provides access-control systems and video surveillance tools, as well as alarm systems.

4th year

Growth: 56.55% Average Annual Growth Rate: 18.85%

Gross Revenue: 2014: $368,000,000 2011: $235,070,000

Full-time employees: 1,409

Fueled in part by a expansion of its nationally known health-care practice, Polsinelli has been among the fastest-growing law firms in the region, and the biggest Kansas City-area based firm as measured by total numbers of lawyers: More than 750 in 18 cities across the nation. The firm also specializes in financial services, real estate, life sciences and technology, and business litigation.

1st year

Growth: 54.67% Average Annual Growth Rate: 18.22%

Gross Revenue: 2014: $3,975,000 2011: $2,570,000

Full-time employees: 41

Established in 2008—a year that will live in banking infamy—Adams Dairy Bank has bolted from the starting blocks and is poised to soon crack the $100 million mark in assets. It’s a community bank in the truest sense, formed specifically to fill a gap in banking services in Blue Springs and eastern Jackson County, and it’s made up of nearly 190 shareholder/owners.

8th year

Growth: 54.67% Average Annual Growth Rate: 18.22%

Gross Revenue: 2014: $82,426,959 2011: $53,293,143

Full-time employees: 1,125

Now more than two dozen strong and established not just in Kansas City but St. Louis, Dallas/Fort Worth and San Antonio, the 54th Street Grill concept continues to bump KRM up the ranks of the area’s largest private companies. Founder Tom Norsworthy built that empire by successfully combining a made-from-scratch favorites dining theme with a vibrant bar setting.

21st year

Growth: 54.45% Average Annual Growth Rate: 18.15%

Gross Revenue: 2014: $3,402,703,000 2011: $2,203,150,000

Full-time employees: 12,800

No company in the 30-year history of the CR100 has more appearances on Ingram’s popular annual ranking than Cerner Corp., a feat made all the more impressive by the size of the health-care IT giant’s revenue base. Organic growth and the strategic acquisitions of Siemens Health Services for $1.3 billion fueled the surge that returns Cerner to this year’s line-up once again.

1st year

Growth: 54.30% Average Annual Growth Rate: 18.10%

Gross Revenue: 2014: $79,575,000 2011: $51,570,213

Full-time employees: 103

Locally owned and operated since 1973, this auto dealership has the region’s largest suburb in its name, but in truth it serves a far broader segment of the metro area, including Kansas City and the other satellite mega-’burbs of Olathe, Lee’s Summit and Independence. It offers new and used Jeep, Dodge and Chrysler products, along with service, parts and body shop work.

5th year

Growth: 54.29% Average Annual Growth Rate: 18.10%

Gross Revenue: 2014: $15,583,031 2011: $10,099,760

Full-time employees: 31

There’s more than reach involved in effective marketing, as Inquest Marketing has demonstrated. Keeping a client’s costs in check to ensure the best ROI on marketing dollars has been its key. The firm applies expertise in research, branding, strategic planning, and other aspects of communications, across all channels, from Web development to social media, digital ad networks and search functions.

10th year

Growth: 52.94% Average Annual Growth Rate: 17.65%

Gross Revenue: 2014: $13,171,081 2011: $8,611,715

Full-time employees: 40

It’s a simple formula for CEO Paul Lawrence and his team at Lenexa-based Challenger Teamwear: Offer quality soccer apparel and equipment at the best possible price, and couple that with outstanding service. For a company founded in 2002, it was also a case of right product at the right time as the nation’s interest in that sport surged.

3rd year

Growth: 52.21% Average Annual Growth Rate: 17.40%

Gross Revenue: 2014: $209,456,000 2011: $137,606,000

Full-time employees: 66

Unlike most bank startups, H&R Block Bank had potential depositors lined up even before it had a charter: It was created to serve banking needs of its tax-preparation clients. Despite a decline of more than 50 percent in its interest income in the three years since 2011, it posted a five-fold increase in non-interest income to remain on a fast-growth track.

1st year

Growth: 51.98% Average Annual Growth Rate: 17.33%

Gross Revenue: 2014: $38,300,000 2011: $25,200,000

Full-time employees: 80

The rebound in construction didn’t treat all contractors equally, but 2014 was definitely Lytle Construction’s year: The Lee’s Summit firm, headed by Ron Lytle, specializes in work on hospital and health-care facilities, and saw it’s three-year growth curve turn steeply sharper, soaring by nearly 50 percent last year alone.

2nd year

Growth: 51.84% Average Annual Growth Rate: 17.28%

Gross Revenue: 2014: $30,041,996 2011: $19,785,896

Full-time employees: 22

A network of independent financial-services professionals, Prosperity Network of Advisors was founded in 1989 and is headquartered in Overland Park. Paul Ewing, one of the nation’s Top 400 financial advisers, according to the Financial Times, leads a network of nearly 120 other financial-planning pros.

11th year

Growth: 51.66% Average Annual Growth Rate: 17.22%

Gross Revenue: 2014: $15,682,000 2011: $10,340,000

Full-time employees: 50

The leadership passed from father to son in 2014, so you knew that a growth factor would still be in the DNA of this Kansas City advertising and marketing firm. Angelo Trozzolo picked up where Pasquale left off, launching a new division last year to focus solely on the marketing needs of law firms trying to compete with megabrands in that sector.

1st year

Growth: 50.68% Average Annual Growth Rate: 16.89%

Gross Revenue: 2014: $10,100,934 2011: $6,703,356

Full-time employees: DD

Success in the restaurant sector draws from a mix of right product and top-tier service, lessons that Gail Lozoff, Ed Brownell and Mike Kramer mastered before launching this concept a decade ago. Today, they have eight Kansas City locations (two under construction) and four franchises, proving that consumers are all-in on hand-spun pizza served with gourmet salads, fine wine and beer, and gelato.

12th year

Growth: 50.41% Average Annual Growth Rate: 16.80%

Gross Revenue: 2014: $272,100,000 2011: $180,900,000

Full-time employees: 784

Steadily climbing the chart of companies with the most CR100 finishes, this public company based in Overland Park is known online by its Web address: egov.com. And that’s exactly what it does, building high-functioning Web sites for local governments, with a mission of helping those entities become “more accessible and efficient for all.”

3rd year

Growth: 49.52% Average Annual Growth Rate: 16.51%

Gross Revenue: 2014: $7,803,488 2011: $5,219,191

Full-time employees: 5

Year-over-year growth is always a challenge in the home-building sector, but there’s no denying the longer-term success for members of the family working at Chris George Homes. A focus on customer service, improved marketing and being up to speed on current home-building trends have all been key success factors, says owner Chris George.

8th year

Growth: 48.02% Average Annual Growth Rate: 16.01%

Gross Revenue: 2014: $5,213,129 2011: $3,522,000

Full-time employees: 4

Brand management solutions that include promotional products, printing services, e-commerce, direct-mail services and trade show/event promotion—all are in the wheelhouse for this Kansas City, Kan., company that annually is among the smallest in Ingram’s Corporate Report 100. But those three full-timers keep nudging the top line up every year.

2nd year

Growth: 47.66% Average Annual Growth Rate: 15.89%

Gross Revenue: 2014: $1,894,667 2011: $1,283,162

Full-time employees: 8

A family business owned by Brian and Amy Gregory, Network Innovations was founded on a belief that a small business owner’s circle of trusted advisers should go beyond lawyer and accountant, and include IT professional. It specializes in communications systems with cloud-based and on-premise phone systems, VoIP and support services, and disaster recovery/data loss solutions.

6th year

Growth: 47.27% Average Annual Growth Rate: 15.76%

Gross Revenue: 2014: $243,000,000 2011: $165,000,000

Full-time employees: 700

The construction-sector crash of 2010-11 was as tough on heavy contractors as it was on anyone else, but the folks at Berkel & Co. know a few things about solid foundations, and they’ve built on one of their own. The employee-owned company, based in Bonner Springs, specializes in infrastructure work such as deep foundations, retaining walls and bracing and shoring projects.

7th year

Growth: 47.00% Average Annual Growth Rate: 15.67%

Gross Revenue: 2014: $5,000,856 2011: $3,402,000

Full-time employees: 31

In architecture, beauty is more than skin deep, and this 34-year-old design firm demonstrates that with architecture and interior design, of course, but also structural engineering and engineering for mechanical, electrical and plumbing systems, as well. It has worked on movie theaters and bowling alleys, bars, nightclubs and more, whether new, renovation or facility upgrade.

4th year

Growth: 46.48% Average Annual Growth Rate: 15.49%

Gross Revenue: 2014: $34,870,000 2011: $23,804,729

Full-time employees: 121

Jim Glynn and George Devins founded this Overland Park firm that helps the booming sector of senior-living communities connect with potential clients and keep those all-important occupancy rates up. The firm takes a broader approach to marketing that includes working with developers, financing companies, architects and others to stay on top of the latest trends.

3rd year

Growth: 46.40% Average Annual Growth Rate: 15.47%

Gross Revenue: 2014: $81,400,000 2011: $55,600,000

Full-time employees: 101

In the aerial dogfight that is fractional aircraft ownership, two competitors went down in flames in recent years, allowing Executive AirShare to capitalize with increased market reach. But this isn’t a game of simple attrition; the Kansas City company also rolled out new programs, added new aircraft and moved into new markets to drive growth.

7th year

Growth: 45.95% Average Annual Growth Rate: 15.32%

Gross Revenue: 2014: $616,189,616 2011: $422,199,917

Full-time employees: 1,000

With almost 1,000 employee owners at 10 locations around the nation, Garney Construction has taken advantage of the rebound in infrastructure work and water-project construction to post record revenues in 2014. If it deals with water, Garney can handle it, specializing in projects that store it, move it and treat large volumes, primarily for states and municipal water systems.

1st year

Growth: 45.19% Average Annual Growth Rate: 15.06%

Gross Revenue: 2014: $60,546,718 2011: $41,702,116

Full-time employees: DD

They say it’s a digital world, but don’t try telling that to the folks at RiteMade Paper Converters, whose three plants in Kansas City, Nevada and Virginia crank out huge volumes of the paper that is the lifeblood of billions of business transactions every year—rolls of paper for cash registers, ATMs, adding machines and about any other business machine that uses paper.

5th year

Growth: 44.02% Average Annual Growth Rate: 14.67%

Gross Revenue: 2014: $281,000,000 2011: $195,113,844

Full-time employees: 274

With three dealerships in Kansas City and Independence, Cable-Dahmer stands as one of the region’s premier vehicle-sales outlets. Led by CEO Carlos Ledezma, this always impressive auto group can deliver new and used vehicles, plus provide sales and service, under the banners of Chevrolet, Buick, Cadillac and GMC.

2nd year

Growth: 43.62% Average Annual Growth Rate: 14.54%

Gross Revenue: 2014: $8,462,000 2011: $5,892,000

Full-time employees: 48

Service. Security. Trust. Those are the pillars that define National Advisors Trust Co., one of the largest independent trust companies in the nation. Rather than tradtional banking services, the company is just what the name says, providing trust and other services to the families it serves and to independent financial advisers nationwide.

12th year

Growth: 43.30% Average Annual Growth Rate: 14.43%

Gross Revenue: 2014: $1,664,150,000 2011: $1,161,300,000

Full-time employees: 3,800

This public company based in Leawood has been on a growth curve since its founding 1994, just three years after the fall of the Soviet Union. The company capitalized on an early presence in former communist states, and has since expanded its range of electronic banking and other financial services in Europe, Asia, Australia and South America.