HOME | ABOUT US | MEDIA KIT | CONTACT US | INQUIRE

HOME | ABOUT US | MEDIA KIT | CONTACT US | INQUIRE

Looking back across half a century of business growth in Missouri, one gets a true sense of the state’s ability to sustain an amazing diversity of business models. Beyond the banks, retailers and insurance companies that are boilerplate elements of any state economy, you see Horatio Alger levels of entrepreneurial success in sectors like energy, biomedical research, hotel construction, transportation, outdoor recreation—even theme parks and tourist attractions.

Going back more than 200 years to formal statehood as part of the Missouri Compromise of 1820, it’s clear that geography and natural resources set the stage for the thriving commerce and quality of life enjoyed today by 6.2 million Missourians. Early explorers found fertile ground for animal hides, lumber and plenty of arable land for farming. Access to two of the most important navigable river systems—the Mississippi and the Missouri—made it feasible to export products to an expanding nation.

At its founding, the state was home to roughly 66,000 hardy souls seeking opportunities in the wake of the Louisiana Purchase of 1803. Then came the tidal wave of human capital that would tame the landscape: Half a million or so by 1845, a million just before the Civil War, 3 million by the turn of the 20th century and 5 million right around the mid-1970s, where our examination of business growth—and leadership figures who drove it— picks up with this special edition.

While business diversity has flourished in that span, looking through the social lens of 2024 reveals a business ecosystem that was almost exclusively dominated by men. Thankfully, that has changed today, but the past can’t. As a historical reflection, the figures presented herein reflect the judgment of editors who have covered that statewide business community for decades, and seen the impact of these towering figures and the contributions they’ve made.

Did we miss some? Almost certainly. But the conversation doesn’t end with this report. Let us know who you believe we’ve overlooked. One never knows how that input might help us shape a 100-year retrospective in 2074…

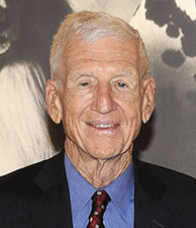

Warner Baxter, Ameren, St. Louis

Warner Baxter, Ameren, St. Louis

When Warner Baxter signed on with the St. Louis area’s biggest electrical utility in 1995, there was no Ameren—it was still Union Electric, yet to be merged with Central Illinois Public Service Co. That wedding produced a sprawling, 64,000-square-mile service area with more than 2 million electric customers (2.4 million today) and more than 900,000 natural gas customers. The relevant operating unit west of the Mississippi is Ameren Missouri, which provides electric generation, transmission and distribution service, as well as natural gas distribution service. Over the course of 28-year career there, he served as the parent company’s CFO, president of Ameren Missouri, then went to the top as chairman, president and CEO of Ameren in 2014. He’s been recognized for outstanding business achievement within the industry and board service with the Edison Electric Institute, Edison Foundation and Electric Power Research Institute.

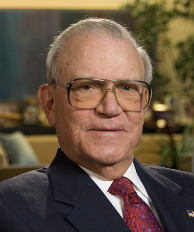

Henry Bloch, H&R Block, Kansas City

Henry Bloch, H&R Block, Kansas City

Returning from his World War II service in the skies over Europe, Henry Bloch carried with him a newfound sense of what truly constituted risks in life. That would shape his world view in business for the next four decades. After 32 missions over Europe, the former B-17 navigator finished his education at Harvard Business School, started an accounting service with his brother Leon, then teamed up with another brother, Richard, in 1955 to found H&R Block. The inspiration for it? The complimentary tax-prep service offered to business clients started generating significant demand from other business owners. Within a decade, the firm was processing nearly 10 percent of the tax returns filed in America for businesses and individuals. It became a public company in 1962, then a global financial-services leviathan, with more than 12,000 offices worldwide.

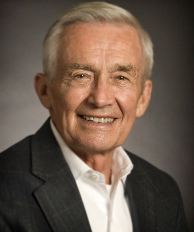

Kit Bond, State of Missouri/U.S. Senate, St. Louis

Kit Bond, State of Missouri/U.S. Senate, St. Louis

Earning his degree with honors from Princeton and finishing first in his law school class at the University of Missouri marked Kit Bond for big things, and did the kid from Mexico, Mo., live up to expectations. Over the course of 40 years of public service, this sixth-generation Missourian served a term as state auditor—he was elected when he was just 32 years old—two terms as governor (the youngest in state history when elected in 1974), then four terms in the U.S. Senate, starting in 1985. In one sense, his statesmanship played out in a bygone era, before D.C. politics became the blood sport it is today; Bond was known for his ability to work across party lines in the Senate to build effective coalitions. After his Senate service, he remained active on the policy front by founding Kit Bond Strategies—branded as KBS Group—a business consulting and lobbying group in St. Louis.

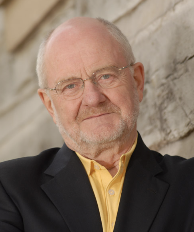

August Busch III, Anheuser Busch/St. Louis Cardinals, St. Louis

August Busch III, Anheuser Busch/St. Louis Cardinals, St. Louis

Various biographies of one-time Anheuser-Busch baron August Busch III—“Auggie”—relate the story of a young man pressured by his father into taking a low-level job at the family brewery after dropping out of college. That might have had something to do, years later, with the famed 1975 boardroom coup that deposed his father as chairman and CEO of America’s biggest beer brand, a move purportedly organized by Busch III. It was a pivotal change in leadership for the famed St. Louis King of Beers, setting the stage for elation—the younger Busch led the company from a 28 percent market share in 1980 to 52 percent in 2002—as well as agony. For just six years after reaching that zenith, the Busch family leadership of the company came to a sudden, unforeseen end when Belgian giant InBev succeeded in executing a hostile takeover. That, in turn, set the stage for job cuts that have halved the brewer’s St. Louis work force since 2008.

George Capps, Entrepreneur/Philanthropist, St. Louis

George Capps, Entrepreneur/Philanthropist, St. Louis

You might say George Capps was driven to success—literally. After a stint with the Navy during World War II, he signed on briefly with the FBI before coming back to his father’s coal company, where he helped drive revenue growth 300-fold between 1950 and 1960. Things really took off when, leveraging his overseas network with coal and coke production, he secured rights to distribute Volkswagens in Missouri, Kansas, Oklahoma, Texas and part of Iowa. That led him to launch his own vehicle-transport company before he turned his sights on real-estate development and, after selling his VW rights, to the founding of Plaza Motors. His influence on St. Louis outside of business was equally profound: He was board chairman for Washington Univ. for three years, led a fund-raising drive that netted the university $630 million, and help gin up funds for various charities, including the United Way and Cardinal Glennon Children’s Hospital. Capps was 72 when he died in 1988.

Maxine Clark, Build-a-Bear Workshops, St. Louis

Maxine Clark, Build-a-Bear Workshops, St. Louis

So…does one recognize Maxine Clark for her business vision and acumen, or for her philanthropic impact on St. Louis? A tough call, because she’s made an impact in both spheres. A University of Georgia journalism graduate, she ended up in the retail sector, arriving in St. Louis working for a division of the May department stores, then became president of Payless Shoe Source. Inspired by the daughter of a friend who suggested building a home-made version of the then-popular Beanie Babies, Clark founded Build-A-Bear Workshop in 1997, and today, it has 500 stores worldwide. She left that CEO role in 2013, when sales hit $379 million, to apply her wealth and entrepreneurial skills to two philanthropic challenges: K-12 public ed and boosting women and minority entrepreneurs. She’s also managing partner in a fund that invests in women-owned businesses, is on the board of Lewis & Clark Ventures, and is a 2006 inductee to the Junior Achievement National Business Hall of Fame.

Sam Cook, Central Bank, Jefferson City

Sam Cook, Central Bank, Jefferson City

Hailing from a prominent Jefferson City banking family, Sam B. Cook served as an artillery and intelligence officer in World War II, finished his degree in economics at Yale and was qualified to go to work about anywhere. Signing on with Chase Manhattan National Bank in New York in 1948, then, wouldn’t raise any eyebrows. But just two years later he came home to Jefferson City, joining Central Missouri Trust Co., the bank founded half century earlier by Sam’s grandfather and namesake. The younger Cook became president and CEO in 1961, charting a course for growth that would make Central not just one of the state’s biggest banks—it had $12 billion in assets when he died in 2016—but one of the most highly regarded with regular appearances on the Forbes list of Best Banks in America. For all his success in business, he was just as impactful as a civic champion and philanthropist, promoting and improving life in Jefferson City.

Bob Costas, Sports Broadcaster, St. Louis

Bob Costas, Sports Broadcaster, St. Louis

Is he a titan of business? Not in the traditional sense, but if you think of him as Bob Costas Inc., he’s done pretty well for an organization with a payroll of one. The longtime sports broadcaster, a native of St. Louis, has been part of some of the biggest play-by-play calls in pro sports history—Super Bowls, NBA finals, various Olympic, major-league baseball and more. That’s worked out pretty well for him, as his net worth is estimated by various sources to be more than $50 million. He was doing well enough to turn down a reported $20 million-a-year, multiyear contract to replace talk-show firebrand Don Imus in 2007. While he’s traveled the world to call the action on the field, the court or the track, Costas has long maintained ties with his native St. Louis, where he started his career with KMOX in 1974. Seven years later, he began a 40-year run with NBC that would make him a sportscasting legend.

Bill Danforth, WashU/Danforth Plant Science Center, St. Louis

Bill Danforth, WashU/Danforth Plant Science Center, St. Louis

His grandfather’s influence on William Danforth was profound in many ways, but three stand out: First, the younger Danforth bore the elder’s name. Second, the family fortune flowed from the pet-feed company Granddad started in 1894. Perhaps most important was the message delivered face to face when young William was just 12: To literally cut the word “impossible” from his vocabulary. That message took, as Danforth went on to become a cardiologist at the Washington University School of Medicine, then chancellor of that institution, where he was credited with pushing it into the highest echelon of U.S. research universities. He wasn’t done making an impact on St. Louis. In 1998, he founded the Donald Danforth Plant Science Center (named after his father), with a goal of improving the human condition through botanical research. He served as chairman at the center for 15 years, and remained closely tied to it until his death, at age 94, in 2020.

Jack Danforth, Danforth Foundation/U.S. Senate, St. Louis

Jack Danforth, Danforth Foundation/U.S. Senate, St. Louis

More than one brother combo is being recognized for impacting Missouri over the past 50 years, but the others were aligned with the same causes. Jack Danforth blazed a trail of his own that led from St. Louis to the United States Senate, then back again to his hometown. You won’t find many ordained Episcopal priests with resumes as hefty as Danforth’s. That success started early, when he was elected to the first of two terms as Missouri’s attorney general—the first Republican to hold that office in 40 years. He changed course to the nation’s capital for a 20-year run in the Senate, where he left in 1995, and followed that up with a short stint as U.S. ambassador to the United Nations under George W. Bush. Most recently, he has used his years of service, where he was respected on both sides of the aisle in a bid to push the GOP to what he believes is a more morally responsible policy orientation.

Charles Drury, Drury Hotels, St. Louis

Charles Drury, Drury Hotels, St. Louis

With its size today—5,000 employees, 150 hotels and a 26-state sweep, you’d expect Drury Hotels to make its home in a big city like St. Louis. But don’t overlook the influence of tiny Kelso, Mo., population 401 in 1970, on the regional hospitality network even today. Lambert Drury passed along his foundational values of dedication and hard work to his sons, first as plasterers, tile-setters and small construction jobs. Charles came back from World War II to help as they moved on to bigger things, like filling stations and churches. But the family business he entered with four brothers took on exponential proportions when it pivoted to ground-up construction and historic-building rehabilitation projects for hotels. First came a Holiday Inn in Cape Girardeau, then the first Drury Inn in 1973 in Sikeston, then a development corporation in 1985 to buy land and build. Drury was 92 when he died in 2020.

David Foss, Jack Henry & Associates, Monett

David Foss, Jack Henry & Associates, Monett

Jack Henry himself gave the company its name, assisted by Jerry Hall at the founding of their company, which they founded in 1976 as computerized operations were moving out of the realm of giant corporations. From a rented space at an engine repair shop in Purdy, Mo., they landed a handful of community banks wanting to tap into data processing efficiencies. From there, Jack Henry & Associates was off and running. By 1999, it was well into acquisition mode and added the solutions division of a firm called BancTec to its ranks, along with David Foss, who had helped arrange the sale and became CEO in 2016. By the time Foss announced his retirement as chairman and CEO earlier this year, the publicly traded company based in Monett, pop. 9,789, had fully evolved into a 21st-century fintech player with annual revenues of roughly $2.2 billion and was serving more than 7,500 client companies nationwide.

Sam Fox, Harbor Group, St. Louis

Sam Fox, Harbor Group, St. Louis

Talk about fitting: When Sam Fox received the Horatio Alger Award in 2005, it was indeed the recognition of a man who had successfully pursued the American Dream and made it his own. The son of Ukrainian Jewish immigrants, he was born in Desloge, the youngest of seven children living in a home that had no heat source for the bedrooms. Not until he was eight did the family have a flush toilet. He worked his way through Washington University, selling Fuller brushes and I-beams harvested from building demolitions. With his business degree in hand, he started Harbour Group Industries in 1976, buying and developing companies in various spheres, from auto accessories and plastic-processing equipment to music and entertainment. His business success led to board service with the likes of Barnes-Jewish Hospital, the municipal opera, science center and zoo, and he even went on to become U.S. ambassador to Belgium under President George W. Bush.

Gordon Gundaker, Gundaker Commercial Group, St. Louis

Gordon Gundaker, Gundaker Commercial Group, St. Louis

In the age of Google, there’s one sure-fire way to demonstrate some-one’s influence in music, politics or business: just type their last name into that search engine. There, Gordon Gundaker stands tall as perhaps the most influential name in St. Louis-area real estate, whether residential or commercial. The native of St. Louis did not come by that success overnight: He labored eight years after selling his first house to become part owner of a realty agency, was the city’s top salesman in 1967, established his own agency a year later, and built it into the largest of its kind in the history of that area, and the seventh-largest nationally. Gundaker formed his current commercial group in 1996, sold off his residential interests in 2001, and continues to impact the region in philanthropy as well as commercial realty, and has racked up a trophy case’s worth of honors, including St. Louis Businessman of the Year and Realtor of the Year.

Donald Hall, Hallmark, Kansas City

Donald Hall, Hallmark, Kansas City

His father, not yet out of his teens, came to Kansas City in 1910 with a pair of shoe-boxes filled with greeting cards to sell. And sell he did, as Joyce Hall laid the foundation for today’s Hallmark. Building on that foundation was his son, Don, who took the leadership baton from the founder in 1966 and carried it through the 1980s. Even today, at 96, he still holds the corporate title of chairman emeritus and his stake in one of the state’s largest private companies, with the family retaining majority ownership. Hall has been a civic champion through his leadership of the Hall Family Foundation, which draws on more than $1 billion in assets to promote causes that improve the region’s quality of life. To that end, Hall was a driving force behind the 2005 transfer of thousands of prints from world-renowned photographers whose works are now safe-guarded by the Nelson-Atkins Museum of Art.

Sam Hamra, Hamra Enterprises, Springfield

Sam Hamra, Hamra Enterprises, Springfield

The practice of law and its interface with politics served Sam Hamra well as this native of Steele, Mo., prospered in private practice and with municipal work for the Ozarks communities of Branson, Nixa and St. Robert. On the political front, he was a three-time delegate to the Democratic national convention, served as a presidential elector and was treasurer for the state party. Things took a major turn in his early 40s when he acquired a Wendy’s franchise, a line that led him into franchising for Panera Bread. And with that move, his business interests really started cooking: Hamra Enterprises today operates nearly 200 restaurants in 11 states, with more than 7,400 people on the payroll. Hamra died just last month at the age of 92, having amassed a legacy of philanthropy and business success that earned him Springfieldian of the Year honors in 2018 and the key to the city in 2022.

Jack Herschend, Herschend Family Entertainment, Branson

Jack Herschend, Herschend Family Entertainment, Branson

Hugo and Mary Herschend ran the first leg of the relay race for what is now Herschend Family Entertainment when they secured a 99-year lease to turn Branson’s Marvel Cave into a tourist destination back in 1950. The pace really picked up when they handed the leadership baton to son Jack, who served as chairman, president and CEO for most of the company’s first half-century. Among his first additions to the attraction was an 1880s-themed village dubbed Silver Dollar City. The payoff there wasn’t entirely commercial: That’s where Jack met Sherry, his wife of 70 years. A Marine veteran who demonstrated a gift for philanthropy in the region, he has supported Lives Under Construction Boys Ranch, Kids Across America and the National Institute of Marriage. He’s also the founder of The Gift of Green, a non-profit that has sought to offset the effects of developmental deforestation by planting nearly 200,000 in the Ozarks.

Peter Herschend, Herschend Family Entertainment, Branson

Peter Herschend, Herschend Family Entertainment, Branson

Co-piloting one of Missouri’s biggest family-owned businesses, Peter Herschend is well-known as one of the founders and owners of Herschend Family Entertainment. In that capacity, he was executive vice president for 20 years, then vice chairman of the board. But his engagement with the city, with the Ozarks and with Missouri runs much deeper. He’s a long-time proponent of public education, but unlike most business leaders, he rolled up his sleeves to do something about it, serving three terms on the State Board of Education, including four separate two-year terms as its president. He’s also been instrumental in helping shape Branson as a tourist destination, with civic roles to address road construction, environmental awareness and making Branson more than an annual summer destination. And like his brother, Jack, he also met the woman he would marry, JoDee, at Silver Dollar City.

Lamar Hunt, Chiefs/Hunt Enterprises, Kansas City

Lamar Hunt, Chiefs/Hunt Enterprises, Kansas City

He left this world nearly 20 years ago, but the legacy of Lamar Hunt lives on in Missouri, on multiple levels. For one, his relocation of an original AFL team from Dallas to KC in 1963 gave the state a presence in two pro leagues. Without that, folks who still yearn for a pro presence in St. Louis would be left without a home-state team to root for in today’s NFL, nearly a decade after Stan Kroenke and his Rams abandoned that city for the west coast. Anyone who switched allegiances to Chiefs Kingdom has been handsomely rewarded since, with four Super Bowl appearances and three Lombardi trophies. More broadly, the real-estate development company Hunt helped form in 1969—we know it as Hunt Midwest today—is crushing it in the logistics space. Its most recent major initiative sprawls across nearly 3,300 acres near Kansas City International, and is billed as the largest development of its type in Missouri.

Bob Jones, The Jones Co., St. Louis

Bob Jones, The Jones Co., St. Louis

Think about the American Dream of home ownership. Now multiply that by more than 15,000. That’s the impact that Bob Jones has had on the St. Louis region since 1961, when he bought the company his father had founded nearly a century ago. Along with business partner Howard Chilcutt, he helped keep The Jones Co. on the latest trends in home design, from Baby Boomer-friendly houses with that third garage to tech amenities that made new homes ready for the digital age with wiring and connections for high-speed Internet access, computer-ready phone and TV outlets, surround-sound home theater systems and other touches. Jones earned a reputation for attention to detail in what customers were looking for in a new home, and for years, he attended every new-home closing personally. In 2003, Bob Jones Co. sold its St. Louis operations to Centex, and used the proceeds along with Chilcutt to set up shop in the Nashville area.

Edward Jones Jr., Edward D. Jones Investments, St. Louis

Edward Jones Jr., Edward D. Jones Investments, St. Louis

His father founded the investment and wealth-management fund that bore his name back in 1922, but when the son came along—he went by “Ted”—the small St. Louis concern took its first steps on the path that has made it a national brand today. The younger Jones, joining the firm after his service in World War II, saw an opportunity to bring wealth-management services into smaller markets, personally opening the first branch office in Mexico, Mo., in 1957. By the time he turned over the leadership to his successor in 1980, Ted Jones had realized his dream of expansion to 300 offices nationwide. He died in 1990, long before the firm had realized its current reach of more than 15,000 offices, 8 million clients and $1.8 trillion in assets managed worldwide. Once asked why the firm never went public, Ted Jones replied, in part, “money has never been my God,” and the firm remains privately owned today.

Ewing Kauffman, Marion Labs/Royals, Kansas City

Ewing Kauffman, Marion Labs/Royals, Kansas City

Mr. K, as he was fondly known by those who worked with and for him, left an indelible legacy not just on Kansas City, not just on Missouri, but anywhere in the world where entrepreneurs nurture a vision. He had one himself, launching a small pharmaceutical sales company in Kansas City in 1950 and built Marion Laboratories into a nearly billion-dollar company before selling to Merrill Dow Pharmaceuticals—a transaction valued at more than $5 billion, and one that created more than 300 millionaires among his employees and investors. Kauffman leveraged his share of the proceeds to bring pro baseball back to Kansas City with the Royals, who started play in 1969. When he died in 1993, he bequeathed the club to the community foundation to carry on his wish that the team remain in Kansas City. His also funded the Ewing Marion Kauffman Foundation, which has earned global renown for its research and promotion of entrepreneurship.

David Kemper, Commerce Bank, St. Louis

David Kemper, Commerce Bank, St. Louis

Family lore holds that when the iconic Kemper family of Kansas City established its biggest toehold in the St. Louis market, Commerce Bank chairman James Kemper Jr. told his sons that someone would have to relocate to oversee the expansion. “One of us,” he said, “is going to move, and it’s not me.” History will have to determine whether David did, in fact, draw the short straw. He left brother Jonathan back at the mother ship bank to succeed Dad, then set about turning Commerce into the biggest locally owned banking brand in St. Louis. Much of that was with his astute networking, forging banking relationships with key business figures in town and aligning with essential non-profits and causes that established the bank’s civic commitment. And some of it was the good fortune to see competitors swallowed up by national banks that lacked the local connections. David Kemper now retired, turned the reins over to his son, John, in 2018.

Crosby Kemper Jr., UMB, Kansas City

Crosby Kemper Jr., UMB, Kansas City

Another member of a multi-generational banking family from Kansas City—and first cousin to James Kemper—R. Crosby Kemper Jr. stood tall in banking circles here, and not just because of his towering 6-foot-8 frame. Though he became president of UMB Bank at the age of 36, the title certainly wasn’t gifted to him: When RCK Sr. hired him after he’d left the University of Missouri, the younger Kemper was assigned to overnight work, picking up shipments delivered by train and sorting checks. But he would become a true civic champion, engaged in far more than banking transactions. When the city was looking to build a new convention center in the 1970s, he was a primary driver behind the fund-raising and pushing of elected officials to make it happen, and the building would bear his name when it opened in 1974. Three of his sons would follow him to the pinnacle leadership of UMB before Kemper’s death in 2014 at age 86.

Ward Klein, Energizer Holdings, St. Louis

Ward Klein, Energizer Holdings, St. Louis

For more than 20 years, Ward Klein was the very picture of corporate citizen in St. Louis: CEO of Energizer Holdings for a decade, and after corporate reorganization, a 10-year run at the helm of successor Edgewell Personal Care Corp. At Energizer, he led acquisitions and organic growth to take sales from $2.8 to $4.4 billion, delivering to shareholders returns that topped 11 percent a year. He signed on with the company after a seven-year stint with Ralston Purina, and served as chairman of its Latin America unit, then of its Asia, Africa, and Middle East operations. In 2002, he became President of the International Division, then COO two years later, and CEO a year after that. Klein has been a civic star on boards for the Missouri Botanical Garden, BJC Healthcare, St. Olaf College and The Sheldon Arts Foundation. He served as president and chairman of the former St. Louis Civic Progress and sat on the board of the Federal Reserve Bank of St. Louis.

Chuck Knight, Emerson Electric, St. Louis

Chuck Knight, Emerson Electric, St. Louis

Back in 1973, when Chuck Knight became CEO of Emerson Electric and a billion dollars was still a lot of money, billion-dollar corporations were a rarity: The Fortune 500 listed just 140 nationwide. It took him only about a year to add the company to that elite roster. And he was just getting started. From $937 million in his first year at the helm—he was just 37 and the youngest CEO of companies in that revenue range—he took Emerson to $1,137.8 in 1975, and the company evolution was in place. On his watch, it grew from a major domestic manufacturer to a leading global technology and solutions provider, with sales increasing 16-fold. Knight’s success as an executive earned him Chief Executive magazine’s accolades as Chief Executive of the Year, and he earned a spot in Junior Achievement’s National Business Hall of Fame. He stepped down as CEO in 2000, retired as chairman in 2004, and died at age 81 in 2017.

Fred Kummer, HBE Corp., St. Louis

Fred Kummer, HBE Corp., St. Louis

Well into his 80s, Fred Kummer was still in the office at the company he and his wife had founded in their home and turned into a national leader in design-build processes. HBE Corp. specialized in health-care (the firm’s portfolio included more than 1,000 hospitals), along with financial institutions, a ski and golf resort, and the Adams Mark Hotel chain. In building that company from the ground up, Kummer applied a work ethic that had far-reaching results. Before his death in 2021 at age 92, he had amassed sufficient wealth to bequeath $300 million to his alma mater, Missouri University of Science & Technology, where he had earned a civil engineering degree in 1955. It was the largest individual gift to a state university in Missouri’s history, funding the Kummer Institute for Student Success, Research and Economic Development. That will allow S&T to focus on instruction in infrastructure, advanced manufacturing, AI and autonomous systems.

Clyde Lear, Learfield Communications, Columbia

Clyde Lear, Learfield Communications, Columbia

Clyde Lear had it all figured out before college: Dentistry would be his calling. But after joining the campus radio station at Central Methodist University, he fell in love with the work and changed his major to journalism. After earning his master’s at Mizzou, he went to work for KLIK in Jefferson City at the princely sum of $85 a week but quit to earn money as a construction materials salesman to support a wife and child. Still, he never gave up on his vision for what would become Learfield Communications, which he began with partner Derry Brownfield as the Missouri Network, producing a statewide farm report that reached nine affiliate radio stations statewide. The company would go on to add a statewide news network, spawn Learfield Sports and eventually reach 1,200 radio stations nationwide with news and sports programming, earning Lear a spot in the Missouri Sports Hall of Fame in 2012.

Jack Lockton, Lockton Companies, Kansas City

Jack Lockton, Lockton Companies, Kansas City

How do you take the traditional model of a local insurance brokerage and turn it into a global enterprise? By following the lead of Jack Lockton, who founded the company that would bear his name in 1966, working out of an office set up in one bedroom of his Kansas City-area home. After bringing aboard his brother, David, the fledgling firm gained momentum, and by the time Jack Lockton died in 2004, his company was approaching the $1 billion revenue threshold, growing from that one-man operation and setting the stage for today’s status as the world’s largest privately held independent insurance brokerage, with 5,000 employees. Lockton thus earned his company a place among Kansas City’s remarkable roster of global enterprises that started with little more than a dream. He was also a civic champion who, among other endeavors, served on the boards of UMKC, the Kansas City Chamber of Commerce, UMKC, and what is now MRIGlobal.

Robert Low, Prime, Inc., Springfield

Robert Low, Prime, Inc., Springfield

Barely more than a kid at 19 and hailing from a Dallas County hamlet of just 369 souls, Robert Low started his journey to logistics greatness, hauling freight with a single truck. That was back in 1970, a decade before he moved operations from tiny Urbana to Springfield in neighboring Greene County. Since then, Low has turned his ambition into a national powerhouse in trucking, with a powerful presence in refrigerated transportation and flatbed hauling. Today, Prime, Inc. operates a fleet of more than 7,700 trucks and nearly twice as many trailers—13,800—producing revenues that have risen steadily for nearly 40 years. With annual revenues of $2.8 billion, Prime has allowed Low to build his dream home—palace, actually—called Primatera Mansion, a massive structure covering more than 50,000 square feet (with another 20,000 in basement and exterior areas) on a nearly 190-acre horse farm north of Springfield.

Alaina Macia, M-T-M Lake, St. Louis

Alaina Macia, M-T-M Lake, St. Louis

The medical transportation company founded by her mother had $30 million in annual revenue when Alaina Macia jumped into the driver’s seat as CEO in 2005 and immediately hit the accelerator. Today, MTM is not only the largest woman-owned business in the St. Louis area, it’s likely the biggest in that class statewide, with 2023 revenues that crossed the ten-figure threshold for the first time, hitting $1.2 billion. That was up 55 percent over the previous year’s $775 million, and it paved the way for a projected $2 billion performance by next year. Her team now numbers nearly 3,000, providing more than 25 million medical transports in 35 states every year. But MTM’s work doesn’t stop there, as Macia has expanded its reach into transportation scheduling software, mobility assessments, and quality assurance services. She holds an MBA in biomedical engineering from Washington University.

John McDonnell, Boeing Co., St. Louis

John McDonnell, Boeing Co., St. Louis

John McDonnell clocked in at McDonnell Douglas Corp. for more than 35 years, serving as chairman and CEO before retiring in 1997. Then he really went to work, this time for the city that had given him and his family so much. Driven to see the entrepreneurial ecosystem expand, he was founding chairman of the board of BioSTL, a non-profit that started up in 2011 with a broad mandate: To encourage capital formation and entrepreneurial activity and to elevate the city as a center of excellence in life science. He also was the founding chair of BioGenerator, which focused on human health and agriculture before merging into BioSTL as its investment arm supporting researchers, entrepreneurs, and regional life-sciences start-ups. On top of those efforts, he was the founding donor for the McDonnell International Scholars Academy, holding a seat on its advisory council and serving as co-chair for the St. Louis Steering Committee for the non-profit Eisenhower Fellowships.

Tom McDonnell, DST Systems, Kansas City

Tom McDonnell, DST Systems, Kansas City

Business success, entrepreneurship, and civic engagement have been the pillars of Tom McDonnell’s contribution to commerce over the course of his working career and beyond. He’s a KC native who earned an MBA in finance from one of the nation’s elite programs, the Wharton School at the University of Pennsylvania. At DST Systems, which started as an information processing and computer software services company spun off from Kansas City Southern Railway, McDonnell oversaw an expansion into an international financial services titan that would become one of the region’s biggest public companies, with $2.22 billion in revenues when he retired in 2012. More than just a business leader, he was a civic champion, leading the efforts to redevelop the Quality Hill neighborhood in a forlorn part of Downtown, where DST was headquartered. He later was president and CEO of the Ewing Marion Kauffman Foundation.

Johnny Morris, Bass Pro Shops, Springfield

Johnny Morris, Bass Pro Shops, Springfield

At the nexus of outdoor life and family-focused entertainment and hospitality stands a Missouri-rooted giant: Johnny Morris. Legendary for building Bass Pro Shops from a one-man bait shop into the nation’s premier retailer of out-door recreational products, Morris has terraformed the southern Missouri landscape with all manner of attractions. Most prominent might be Big Cedar Lodge south of Branson, which draws people by the thousands to Table Rock Lake for fishing, boating and family vacations. But there’s also Springfield’s Wonders of Wildlife, the two-track museum (aquatic on one side, terrestrial on the other) that immediately became a national draw when it opened in 2017, the Top of the Rock golf course near the resort, and Dogwood Canyon Nature Park, one of Morris’ first development home runs when he began amassing land in 1990 to create a sprawling, 10,000-acre tribute to the Ozarks.

Michael Neidorff, Centene Corp., St. Louis

Michael Neidorff, Centene Corp., St. Louis

One can’t think of Centene’s rise to national prominence without considering the contributions of Michael Neidorff, who came on board as CEO in 1996 and hit the growth afterburners: Over the next quarter-century, he took a $40 million single health plan and transformed it into a $125 billion multinational health-care monolith with 25 million members. As a result of his leadership, Centene today is ranked No. 24 on the Fortune 500 list of U.S. companies and No. 57 on its 500 Global list, with nearly 76,000 employees across the U.S. and three other countries. A native of Altoona, Pa., he earned a degree in political science from Trinity University in San Antonio and a master’s in industrial relations from St. Francis University. After racial strife rocked nearby Ferguson in 2014, he led a civic initiative that raised $30 million to support business investment in that community. Neidorff was 79 when he died in 2022 of complications from an infection.

Charlie O’Reilly, O’Reilly Automotive, Springfield

Charlie O’Reilly, O’Reilly Automotive, Springfield

Within three generations of a family-owned company that would become public 36 years after its founding, there was always plenty of credit to go around for organizational growth. But a key player in national prominence for O’Reilly Auto Parts was Charlie O’Reilly, grandson of the founding patriarch, who took the reins of the retail store division in 1975, drove growth for 18 years in that role, and finally retired from the company board in 2018. He was the linchpin in growth that saw the company become publicly owned in 1993, an initial offering that netted $41 million (more than $90 million in today’s dollars) and set the stage for huge expansion. Some perspective on that explosive growth: Charlie had been at the helm for 14 years before the company opened its 100th store; today, it has nearly 6,250 across North America and had 2023 revenues of $15.8 billion.

Neal Patterson, Cerner Corp., Kansas City

Neal Patterson, Cerner Corp., Kansas City

The executive face for one of KC’s great entrepreneurial success stories of the past 50 years was Neal Patterson, the late CEO of Cerner Corp. But he was just one part of the original brain trust for what would become a global health-informatics company. Former Arthur Andersen colleagues Cliff Illig and Paul Gorup joined Patterson to launch their company in 1986. It leveraged the health-care’s craving for comprehensive and accessible digital patient records and health histories to soar up the list of the Kansas City region’s largest private employers, eventually hitting No. 1. At its peak, Cerner had nearly 14,000 on the Kansas City-area payroll and about 25,000 world-wide. A native of the vast wheat-growing region of southern Kansas and northern Oklahoma, Patterson earned a finance degree and then an MBA from Oklahoma State before signing on with Arthur Andersen. He was 67 when cancer claimed him in 2017.

Robert Plaster, Empire Gas/Evergreen Investments, Lebanon

Robert Plaster, Empire Gas/Evergreen Investments, Lebanon

Hailing from the small Missouri town of Neosho, nothing was gifted to Robert Plaster. He had to drop out of Joplin Junior College after three semesters because he couldn’t afford the tuition. But when the opportunity came, he seized it, founding Empire Gas Corp. in 1963 and building it into one of the largest retail propane gas distributors in the United States, with a listing on the New York Stock Exchange. He sold it in 1996 and founded Evergreen Investments, and soon after, became an evangelist for free enterprise. He co-founded and actively supported Enactus, at that time known as Students in Free Enterprise, and established the Robert W. Plaster Foundation, earmarking major donations for buildings to promote entrepreneurship at UMKC, Park College, and Missouri State University, among others. His love of automobiles inspired the creation of Evergreen Historic Automobiles, featuring his private collection. He died in 2008.

Rodger Riney, ScottTrade, St. Louis

Rodger Riney, ScottTrade, St. Louis

Rodger Riney left the University of Missouri with a civil engineering degree—and an MBA. The latter would be the wind in his career sails, as he turned down an engineering job and founded a discount brokerage firm, Scottrade. Riney eventually built it into a national heavyweight in that space, with 500 branch offices in 48 states, 3 million client accounts and more than $170 billion in assets under management. In 2015, he was diagnosed with blood cancer, and two years later, he sold the firm to TD Ameritrade for a reported $4 billion. His life’s work earned Riney a spot on Forbes annual list of U.S. billionaires, with an estimated net worth of $3.6 billion, and he’s devoted a significant amount of that, personally and through the Paula and Rodger Riney Foundation, to support medical research, including $40 million to Washington University in St. Louis to develop treatments for neurodegenerative diseases.

Joseph Rupp, Olin Corp., St. Louis

Joseph Rupp, Olin Corp., St. Louis

When he retired from Olin Corp. in 2017 after 45 years of service—15 of them as CEO—Joseph Rupp left behind a company that had a significantly larger business footprint than the one he inherited in 2002. Rupp is credited with steering Olin through a business transformation that made it a global leader in the production of industrial chemicals. It ranked No. 1 for the production of chlor alkali and membrane-grade caustic soda, epoxy materials, chlorin-ated organics, chlorine, and industrial bleach, among other products. It is perhaps better known as a leading U.S. manufacturer of small-caliber ammunition, much of which is produced for the Defense Department. A big achievement came in 2015 when he oversaw the acquisition of Dow Chemical, providing a boost that pushed Olin’s revenues past $6 billion. Rupp earned his degree in metallurgical engineering from Missouri University of Science & Technology in 1972, and after leaving Olin held various board duties.

![]()

![]()

![]() Schnuck Brothers, Schnucks Markets, St. Louis

Schnuck Brothers, Schnucks Markets, St. Louis

There’s really no way to single out any one member of the Schnuck siblings for their contributions to St. Louis or the state and regional economy. Craig, Scott and Todd Schnuck have all taken successive turns at the helm of one of the nation’s largest independent grocery chains. Founded in 1939, Schnuck Markets is into its fourth generation of family members overseeing 115 stores in Missouri, Illinois, Indiana and Wisconsin. The Schnucks have been linchpins in civic life, as well: Craig is a board member at Washington University; Scott has a similar role with the St. Louis Sports Commission; and Todd, the current CEO, is a past co-chair of the annual community campaign for the United Way of Greater St. Louis. The company’s 12,000 employees produced $3.2 billion in 2023 revenue, ranking No. 189 on Forbes list of the biggest U.S. private companies.

Rex Sinquefield, Dimensional Fund Advisors/SMI, St. Louis

Rex Sinquefield, Dimensional Fund Advisors/SMI, St. Louis

Want to label Rex Sinquefield? Good luck with that: He’s a businessman and innovator, for sure, having cracked the code on index funds back in the 1980s to help investors produce returns that easily outpace human guesswork. The wealth amassed through his Dimensional Fund Advisors now helps him spread the gospel of free markets through his funding of the Show-Me Institute, a public policy think tank. He’s even earned recognition for positioning his home town as Chess Capital of the World, promoting the game of strategy for 60,000 students through his Saint Louis Chess Club (efforts, by the way, that earned him induction into the U.S. Chess Hall of Fame in 2020). His achievements belie the harsh environment of his youth, growing up in a Catholic orphanage, but he has used the blessings of his financial services juggernaut to finance the political campaigns of candidates who embrace his free-market worldview.

Jack Stack, SRC Holdings, Springfield

Jack Stack, SRC Holdings, Springfield

You might think of Jack Stack as a businessman, but you’d be wrong. Not technically wrong, but off the mark: He’s a serial businessman, and there’s a big difference between what he does and what a typical business owner does. He’s president and CEO of SRC Holdings, a family of 10—yes, 10—companies specializing in automotive-related manufacturing. Combined, they produce $1 billion in annual sales and a team of more than 2,000 employee-owners. It all started back in 1983 with a Stack-led employee buyout of an International Harvester factory. He threw out the old way of doing business and embraced open-book management—you can read all about it in the books he co-authored, “The Great Game of Business” and “A Stake in the Outcome.” A fierce advocate for employee ownership and empowerment—they are not the same thing—he’s also a philanthropic force in Springfield.

Dave Steward, World Wide Technology, St. Louis

Dave Steward, World Wide Technology, St. Louis

The company Dave Steward founded in 1990 had $20 billion in global revenue last year, a record of business success that over-shadows far humbler beginnings: selling rail services for Missouri Pacific Railroad, then signing on with Federal Express as a senior account executive, good enough at the trade to earn a spot in the FedEx Sales Hall of Fame. His real calling, though, came as an entrepreneur, when he and Jim Kavanaugh launched World Wide Technology with a handful of employees and a few key government accounts. The stunning transformation over 3-1/2 decades has made Steward one of the wealthiest men in the state; he was one of only 13 black billionaires in the U.S. profiled by Forbes magazine in 2019. That success has also made him a pillar of philanthropy in St. Louis and beyond, particularly with non-profits that advance diversity, equity and inclusion for historically underrepresented communities.

Jim/Virginia Stowers, American Century/Stowers Institute, Kansas City

Jim/Virginia Stowers, American Century/Stowers Institute, Kansas City

Jim Stowers Jr. turned a one-man startup into a wealth-management colossus on a national scale, but for pure Missouri impact, you have to look at what his wife, Virginia, contributed with him after his business-leadership days were over. Both were cancer survivors late in life, and their health-care challenges inspired them to donate virtually all of their combined fortune—$2 billion at the time—to found the Stowers Institute for Medical Research in Kansas City. They acquired the former Menorah Medical Center across the street from UMKC, began transforming it into a research facility, and opened the doors in 2000. That massive capital infusion instantly elevated Kansas City in the nation’s hierarchy of life-science research centers, and the cancer-fighting work continues today with millions in annual funding provided by profits from Stowers’ American Century Investments firm.

Andy Taylor, Enterprise Mobility, St. Louis

Andy Taylor, Enterprise Mobility, St. Louis

Jack Taylor came back from World War II and started a car-leasing company, but for most of the past half-century, his son Andy was behind the wheel on the company’s journey to national power-house in that space. After serving as CEO from 1991 to 2013, he’s now executive chairman of Enterprise Holdings, overseeing an empire that includes the original Enterprise Rent-A-Car brand plus the acquired Alamo Rent-A-Car and National Car Rental brands. That grip on the market, thanks to a global network of regional subsidiaries and franchise locations, has produced more than 9,000 locations in more than 70 countries, making it the largest car rental company in the world by any measure—revenues, fleet size or employee head-count. Rentals and fleet-management services have built an armada of 1.7 million vehicles worldwide, with additional functions in car sales, truck rental, sharing services, cycle rentals—even exotic cars.

Robert Trulaske, True Manufacturing Co., O’Fallon

Robert Trulaske, True Manufacturing Co., O’Fallon

What Whirlpool or GE are to kitchen refrigerators, True Manufacturing has been to commercial refrigerators and displays for more than 75 years. The roots of what is now a global enterprise run to Robert Trulaske Sr. and the work he put in with his father and brother, developing an upright freezer system in their garage after his return from World War II. Born in St. Louis in 1918, Trulaske earned a business degree at the University of Missouri, a program that would eventually bear his name. The endowment fund he created with his wife continues to provide financial support for nearly three dozen students at the Robert J. Trulaske Sr. College of Business in Columbia. In tribute to that support, MU in 2002 awarded Trulaske an honorary doctorate of Humane Letters for outstanding achievements in his business career. He was 86 when he died in September 2004.

George Walker III, Stifel Financial, St. Louis

George Walker III, Stifel Financial, St. Louis

If the name sounds familiar, it should. George Walker III’s first cousin was the late president, George Herbert Walker Bush. Their familial influence on the nation’s political scene is well-known, but so is the family footprint on St. Louis. A St. Louis native and hard-core Cardinals fan—his father, ironically, had been a minority investor in the New York Mets start-up—Walker graduated from Harvard University before going to Yale Law School. He could have followed into the family’s well-established public service line but chose to return home and make his mark in the financial services world. Walker became chairman of Stifel Nicholas, a brokerage and investment banking firm, which later morphed into the financial services firm that is now the parent of Missouri’s largest bank in terms of assets. He also served as U.S. ambassador to Hungary during the second Bush presidency. He was 89 when he died in 2020.

Howard Waltman, Express Scripts, St. Louis

Howard Waltman, Express Scripts, St. Louis

Howard Waltman helped plant the seed that sprouted to what today is one of the nation’s biggest pharmacy benefit-management companies, taking the reins of a newly formed Express Scripts in 1986, then steering its growth to become a public company as CEO before he handed the reins off to Barrett Toan in 1992. That IPO set the stage for growth at a company that would eventually become one of the largest employers in St. Louis—with 30,000 staffers nationwide—before it was sold to Cigna for a whopping $67 billion in 2018. Before he jumped in at the new venture in pharmacy services, this native of New York had been around the world as a consultant to the South Vietnamese, then came home to launch several health-care and data processing start-up companies. How powerful was the brand he helped establish? Though Cigna rolled out a rebrand in 2020 as Evernorth, the ExpressScripts.com domain is still active. He died at 89 in June 2022.

Mark Wrighton, Washington University of St. Louis, St. Louis

Mark Wrighton, Washington University of St. Louis, St. Louis

Two numbers pop right out on the timeline of Mark Wrighton’s life: the nearly 24 years he served as chancellor at the state’s premier private university and the 22 years from birth to his PhD in chemistry. Each tells a powerful story about what he brought to the game as chancellor at WashU from 1995 to 2019. His first degree in chemistry, from Florida State University, came when he was 20. The doctorate at Caltech came two years later, setting him up immediately for the chemistry faculty at MIT. He rose through the ranks to become provost in 1990, five years before WashU came knocking. Nearly a quarter-century later, he had overseen an increase in student quality, directed major physical improvements to the campus—an impressive new 50 buildings, total—bolstered the curriculum, elevated WashU’s international reputation and tripled undergraduate applications.