Building a New Construction Sector

Contracting, architecture executives say the belt-tightening they did during the downturn has them poised for growth in an economic rebound.

Like most construction-related disciplines, contractors, architects and designers in Kansas City took a shot to the ribs during the prolonged downturn in their sector. While nobody’s screaming “Hey, economy: Is that all you got?” there is a growing sense of confidence that firms in the region have absorbed the body blows and are ready to fight back.

Construction company numbers are firming up, and among nearly 40 architectural firms in the region, from large-scale global operations like Populous and 360 Architecture, down to one-man shops, the overall numbers of licensed architects in 2013 are comparable to the 2012 levels. So the bleeding has stopped.

Recent trends, professionals in those disciplines say, are breaking their way. But even if the recovery isn’t as strong as they’d prefer, companies are maximizing on the potential returns because of the internal operational changes they’ve embraced over the past five years.

“From a broad perspective, it is a new economy, and margins are much tighter, so you have to be lean, you have to be more efficient, you have to leverage technology to earn a reasonable return,” said Dirk Schafer, president of J.E. Dunn’s Midwest Region. “I think that the biggest change from a project standpoint, you score runs by stringing together a bunch of singles, and not a lot of home runs.”

Throughout much of the downturn, Kansas City’s construction and design sector drew on a long and wide pipeline of large-scale projects, such as the National Security Administration’s $650 million lab in south Kansas City, or the Kauffman Center for the Performing Arts, which opened in 2011. Federal stimulus funding also helped, but that funding, as with a lot of state and local government money, is becoming harder to tap into.

The dynamic experienced by J.E. Dunn Construction has spread through the sector, not just with contractors, but architectural and design firms. Having embraced leaner operations, they, too are poised to capitalize on economic growth. Populous, in fact, has hired more than two dozen people in the past eight months, almost all of them licensed architects, said Jon Knight, senior principal and designer.

“We started to see the lift, the improvement in the overall climate, in 2011 and it continued through ’12—not great, but it was good” compared with 2009–10, Knight said. “So far this year, there’s been a continuation of that healthy trend in terms of clients contacting us, RFPs to respond to, the work we’ve been able to book.” And the outlook into 2014 hints of still more to come, he said.

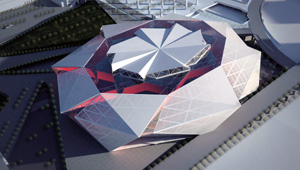

Back in Style | Kansas City’s 360 Architecture has won a $35 million contract for work on a new stadium for the Atlanta Falcons, which would incorporate an innovative new design. That job is another sign that the construction fog of 2008-2012 is lifting.

At 360, which just last month secured a $35 million contract for work on a radical new stadium design for the Atlanta Falcons, strength has come from a broad approach to its work. The firm, said principal David Rezac, “is fortunate to be diversified and involved in several keys markets that are showing signs of increased activity and growth.”

While the local commercial market is still struggling, he said, corporate tenant improvements and adaptive re-use projects are strong now and appear to be for the foreseeable future. “We have witnessed a trend with companies renegotiating existing leases instead of moving,” Rezac said. “Some companies are investing in their internal infrastructure, providing significant upgrades to their technology and A/V platforms to improve the bottom line.”

So while the industrial market looks to be picking up, Rezac said there seemed to be few new buildings on the horizon—especially corporate office buildings.

Efforts to capitalize on a resurgent construction economy have been abetted by a strong talent pool, especially among younger architects who’ve recently completed school. “Hungry” was Rezac’s word to describe them. But the effects of a prolonged stagnation will show up in the staffing of firms for years to come.

“The talent pool is actually, very good,” said Knight. “But I think one thing we’ve found is that it’s very difficult to find people who have that sort of five or six years of experience. That generation, that brief generation and that group of young intern architects disappeared off the map because they said, ‘I’ve got to get out, find employment somewhere,’ and they haven’t come back in. That’s the group we’ve had a hard time finding.”

Rezac said 360 saw much the same thing. “Unfortunately, some very valuable people did leave the industry,” he said. “What we’re seeing from new college grads is some great young new talent that is very hungry.” Throughout the slowdown, he said, the firm didn’t pull the plug on recruiting efforts. “We still interviewed, talked to people even if we were not hiring, so when things turned around, we’d have gone through the processes to see what the pool was like.”

That paid off with recent hires who could be quickly brought in, he said.

Going forward, Knight said, pent-up demand will keep the pipeline flowing, but in an altered dynamic, especially with an anticipated decline in public-sector projects. “Some is smaller scale,” he said. “I would say it’s not necessarily a seismic shift in the type, scale or size of projects, but over the past few years, we’ve seen more smaller scale work funded through capital improvements and annual budgets for repair and maintenance, as opposed to big capital expenditures for new additions, or buildings.”

Rezac said a diverse service line had similarly positioned 360 for growth. “It has allowed us to maintain our valuable staff, eliminate costly layoffs, and give our resources different project types and people to work with,” he said. “The by-product is a more well-rounded and experienced architect. We also took time during the recession to evaluate our internal processes, to enhance how we were using technology to collaborate and streamline our production model.”

Like the architectural firms, contractors will be working in a new paradigm for years to come, Schafer said. A big determinant of success for all concerned is the availability of capital for construction and design projects.

“With all the issues in the banking sector coming out of the mortgage crisis, just getting money back into the system to support private development is an issue,” Schafer said. “The public sector, while it helped during the downturn, has really showed down. GSA budgets are just a fraction of what they used to be.”

He also noted a recent study that showed half the commercial building inventory in the nation was less than 20 years old—which implies that half is more than 20 years old. As business practices change and physical plants evolve, those older buildings will require additional work to remain viable.

“That area continues to be a big demand,” Schaefer said. “It’s a completely unscientific fact, but I’ve been in the industry 33 years, and we’re doing second- and third-generation tenant improvements on buildings that I built early in my career.”

But overall, Schafer said, “there is an uptick, and we’re more optimistic about the market than we have been in past three or four years.