HOME | ABOUT US | MEDIA KIT | CONTACT US | INQUIRE

HOME | ABOUT US | MEDIA KIT | CONTACT US | INQUIRE

What, really, is cryptocurrency? Is it just a trendy investment for gunslingers looking to capitalize on wild swings in its market valuation? Is it just the latest in a series of convenient ways to conduct on-line transactions by working around the middleman of a financial institution? Is it truly a disruptor that could erode the foundations of a banking structure that’s centuries old? If you’re a banker today, it’s all of those things and more—it’s a potential threat.

In February, JPMorgan, the nation’s largest banking institution, issued a regulatory filing that touched off a wave of similar concessions from America’s biggest banks. “Both financial institutions and their non-banking competitors face the risk that payment processing and other services could be disrupted by technologies, such as cryptocurrencies, that require no intermediation,” JPMorgan officials wrote. “New technologies have required and could require JPMorgan Chase to spend more to modify or adapt its products to attract and retain clients and customers or to match products and services offered by its competitors, including technology companies.”

Before long, Bank of America, Goldman Sachs and other giant financial-services firms chimed in. Widespread adoption of new technologies in financial services, including cryptocurrencies, the bank warned, “could require substantial expenditures” in its response to changes in consumer preferences and industry standards. And that filing specifically pointed out that digital currencies limit the bank’s ability to track movement of funds and comply with laws such as anti-money laundering regulation.

Asked to comment for this story, area bankers weren’t chomping at the bit to offer their thoughts; a great many are still waiting to see where the cryptocurrency evolution is headed. And executives from larger area banks that are publicly owned have compliance reasons for not wanting to make public proclamations about how digital currencies might affect their business models.

“I’m not sure that the big banks are truly afraid of cryptocurrency, but they are thoroughly interested in the blockchain technology that underpins it,” said one regional banking executive. “They may be disclosing it as a potential threat in the SEC filings due to the nature of such filings, but I don’t think they view it as a threat.” Brian McClendon, a former Google executive who is now a research professor at the University of Kansas, said one factor that may be most disconcerting to banks is the loss of ownership. “Bitcoin is a distributed database of coins; you can move bitcoins between participants, and the public ledger is validated by multiple entities,” he said. “When these multiple computers agree on a version of the truth, it can’t be changed. Longer-term, the fear the banks have is that a database that is consistent and trusted—but not owned by a single entity—means that settling transactions can be done very, very efficiently, without a big company being the gatekeeper.”

“I’m not sure that the big banks are truly afraid of cryptocurrency, but they are thoroughly interested in the blockchain technology that underpins it,” said one regional banking executive. “They may be disclosing it as a potential threat in the SEC filings due to the nature of such filings, but I don’t think they view it as a threat.” Brian McClendon, a former Google executive who is now a research professor at the University of Kansas, said one factor that may be most disconcerting to banks is the loss of ownership. “Bitcoin is a distributed database of coins; you can move bitcoins between participants, and the public ledger is validated by multiple entities,” he said. “When these multiple computers agree on a version of the truth, it can’t be changed. Longer-term, the fear the banks have is that a database that is consistent and trusted—but not owned by a single entity—means that settling transactions can be done very, very efficiently, without a big company being the gatekeeper.”

And unlike the Swift payment system in use globally—which can take 1-3 business days, or more, to complete a transaction, blockchain “approval” is nearly instantaneous. Swift has its own drawbacks—one reason why banks are optimistic about blockchain near-term. “It’s one of the things banks are working on now,” said McClendon. “The goal is to use that transaction mechanism to help banks and others move information and money without the overhead of the existing system. They’ve not replaced anything yet; they haven’t solved it—but people believe it is coming.”

As far cryptocurrency’s investment potential, the banker introduced earlier offered up a history lesson: Tulip bulbs were wildly popular stores of value with a huge increase in value in Holland for a short time in the 17th century, “until folks woke up one day and realized they were tulip bulbs. While there’s a lot of sexiness and hype around Bitcoin and cryptocurrency; it’s air—or bits—and it’s hard to believe that something that was worth a few pennies a few years ago was suddenly worth $20,000 a few months ago and now considerably less.”

But to the extent it exists at all, what creates that value? As an investment tool, “there is nothing substantive behind it,” the banker said, other than the whims of market psychology on a given day. It’s a fun, speculative investment, but who would want to transact business with something on a regular basis that’s so volatile?”

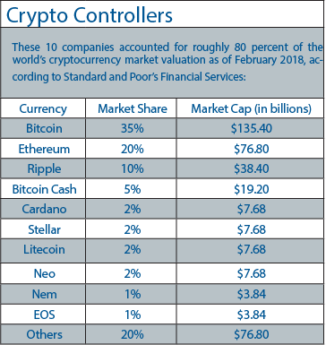

The underlying appeal, the thing that makes cryptocurrencies work, executives say, is the blockchain technology that supports their use, and it adds value—some value—to those digital currencies as investment opportunities. But there are limits, wealth managers caution. “Blockchain technology is a real thing; a lot of people are going to use it, it’s being used by big corporations like IBM and Accenture that are the S&P 500,” says Peter Mallouk, president of Leawood-based Creative Planning. “If someone owns a diversified portfolio of stocks, they’re invested in blockchain.” But with thousands of cryptocurrencies now in existence, and more coming into use each day, he said, the odds aren’t in favor of someone betting that any one of them is going to emerge as a long-term standard.

For investors with ice water in their veins, he said, “there might be a few that emerge that really do hold value, the odds that it’s going to be Bitcoin or one of these others are extremely small—very, very small.” Eventually, he said, “there’s going to be a very big group of people that most likely is going to lose all of their money.”Still, the ability to have instant access to both transaction payments and to verified legal documents creates new opportunities and new efficiencies for financial-services firms. And that value goes well beyond financial transactions. For example, someone moving across state line in the Kansas City area could, conceivably, see immediate title transfer of a vehicle, with updates on lien-holders, rather than going to a motor-vehicle or tax office and burning half a day in line.

For banks, the bigger concern is how to preserve control over the payment system. For upstart competitors, it’s finding a way beyond a system that it would be, basically, a closed loop: Products and services would be limited to what that company has to offer, so transactions within the system would be little more than a recirculation of dollars. “It’s hard to imagine in the real world some privately operated system becoming preferable to the Federal Reserve System and the backing of the U.S. government,” the banking executive said. “Edges can be nibbled, but I don’t think they can replace the current system, which is what the banks are most concerned about.”

In the end, bankers say, cryptocurrency transactions are just one part—a small one, at that—of a large range of financial-services transactions that invariably will include traditional banks. One reason for that is that banking entails relationships with clients that are more than electronic signals. And in that sense, big banks and community banks are all in the same business. “The role of building relationships is likely not much different between large and small banks, as it is critically important to all of us,” says Doug Gaumer, market president for INTRUST Bank. “One of the differences that smaller banks might promote is that customers have easier access to decision makers, and that is probably true to a point. By comparison, larger banks, both regional and national, bring a breadth of experience, expertise and sophistication across multiple disciplines that smaller banks simply cannot deliver.”

The depth of relationships might differ, as the presumption is that smaller banks are more flexible and responsive to customer’s than larger banks, Gaumer said, but “those traits are now expectations, not differentiators. In order to be differentiators, banks have to think about value creation in terms of providing products and services, as well as, commercial insights that helps the customer’s bottom line and/or reduces risk.”

Where does this go from here? “We’re very early into this,” said McClendon. “People are saying ‘let’s do blockchain for this, or for that. Right now, most blockchain/ICO companies haven’t even done it yet—they’re just talking. There is definitely a lot to explore that you could apply blockchain to. We haven’t seen nearly the beginnings of this.”