Long-Planned

KC Southern-Mexican

Railway Deal Finally “On Track”

by MATT EHRHORN

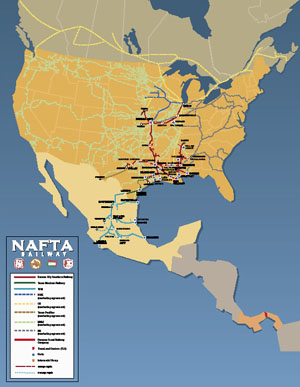

The leading railway system in Mexico, TFM connects Mexico City, three major ports and the industrial core of Mexico to KC Southern’s domestic railways at the Laredo/Nuevo Laredo Texas border. Under KCS’s ownership, TFM will be operated as an independent Mexican corporation with Mexi-can leadership. The acquisition basically dou-bles KCS’s size, making it the principle Class 1 rail carrier in the North American Free Trade Agreement corridor covering 5,300 miles be-tween the Midwest, central Mexico and several developing Mexican ports along the Pacific.

After the March 29 vote, KCS Chairman, President and CEO Michael R. Haverty said, “We are very pleased that our shareholders, the regulatory bodies in Mexico and the U.S., and our Mexican partner have agreed to placing these railroads under common control.” Referring to KCS’s and Grupo TMM’s joint operation of TFM since 1997, Haverty continued, “With the railroads already physically linked in an end-to-end configuration, common control will enhance competition and give shippers in the NAFTA trade corridor a strong transportation alternative as they make their decisions to move goods between the United States, Mexico and Canada. It will also allow the company to create greater value for shareholders through the oper-ating efficiencies that will come from common ownership and control.”

The TFM acquisition has not been a particularly smooth one. Part of the hold-up was due to KCS and TMM having to wait for the Mexican Fiscal Administration Service (“Servicio de Administracion Tributaria” or SAT) to finish auditing TFM’s tax returns from 1997, when the company, with KCS and TMM, bought majority interest in TFM from the Mexican government. The SAT contested that TFM had not provided sufficient documentation in compliance with Mexican fiscal code requirements and was therefore not entitled to its 1997 tax returns to depreciate and deduct the concession title, railway equipment and other assets of TFM at the time of its privatization.

On March 18, 2005, the SAT notified TFM that it had finished its audit, though details regarding penalties or tax assessment had not been released at the time. The SAT’s notification came after the Mexican Appellate Court ruled in January that TFM was entitled to receive a value added tax (VAT) refund certificate of $195 million from the Mexican government. Through inflation and interest increases since 1997, TFM’s VAT refund could likely amount to $1 billion. Believing the SAT’s audit findings to be without legal merit, KCS and TMM expect TFM to contestlegally any potential penalties or taxes that the SAT might charge.

Aside from tax refund negotiations and potential legal disputes on the horizon, KCS and TMM are still in discussions to purchase the Mexican government’s remaining 23 percent stake in TFM, for which it has an option to sell.

In addition to TFM, KCS owns the Kansas City Southern Railway Company (KCSR), founded in 1887, the Texas Mexican Railway Company (Tex Mex), founded in 1885, and the Gateway Eastern Railway Company. KCS also has an investment in the Panama Canal Railway Company, which provides ocean-to-ocean freight and passenger service along the Panama Canal. Additional information about Kansas City Southern and the newly acquired TFM railway can be found at www.kcsi.com.