Karen Garrett blamed not the regulators, but the legislators. “Many of the people at the Fed in particular clearly understand that we’re over-disclosing,” she said. “We’re giving so much information that nobody can understand it.”

“The Fed in my opinion did a really good job of balancing the competing interests,” agreed Mark Hargrave, “but over the last two or three years, the regulators hands have been substantially tied.”

“A lot of this legislation is written more like rules than legislation,” added Chuck Morris, “and other parts are just so wide open that you just don’t know how it’s all going to come out.”

1: Tom Jackson foresees more niche banking, because too many smaller banks have tried to be all things to all people. | 2. Bank valuations will suffer, said Steve Fleischaker, because few will pay full price for a bank when the government is subsidizing cheaper acquisitions by shutting down weaker institutions. | 3. Co-chairman Kevin Cook did his best to close the meeting on a positive note, but the general consensus of the room was that the best thing to come from this legislative sausage-making was that it's been passed, and can't get any worse.

1: Tom Jackson foresees more niche banking, because too many smaller banks have tried to be all things to all people. | 2. Bank valuations will suffer, said Steve Fleischaker, because few will pay full price for a bank when the government is subsidizing cheaper acquisitions by shutting down weaker institutions. | 3. Co-chairman Kevin Cook did his best to close the meeting on a positive note, but the general consensus of the room was that the best thing to come from this legislative sausage-making was that it's been passed, and can't get any worse.

Viability

“So how big,” asked Mike Lochmann, “does a bank have to be, now, going forward, to be viable in this new regulatory environment?” Greg Bynum suggested a baseline of $1 billion in assets, perhaps a billion-plus.

“How many banks serving rural areas of Missouri and Kansas are close to that?” asked Lochmann.

The answer is, precious few. “I think it will cause us to consolidate or sell out to the larger organizations,” said Bynum. The problem, he added, is that given the difficulty of raising capital, buyers are not there at a multiple that’s going to be reasonable.

“Going forward,” said Tom Jackson. “Banks will adopt the concept that they can not be all things to all people, which they have been trying to be for a number of years.” Jackson expects to see some niche lending and niche deposit-type products emerge.

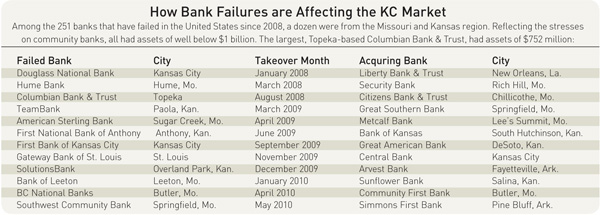

For the foreseeable future, Steve Fleischaker does not expect to see buyers go out and pay anywhere near what the investors in that bank need, at least as long as those same buyers can still grab failed institutions at discounts with government support and subsidy.

Positives

When Kevin Cook asked whether any positives might be coming out of the legislation, he was met with a long moment of silence.

Once the regulations are written, Steve Fleischaker said, banks will at least be able to move beyond the uncertainty and into a new established reality. Mark Hargrave added that the ability to do de novo branching nationwide could be a benefit, but not one that would be practical for those institutions represented at the table.

As Julius Madas observed, everyone is looking for that silver lining. When prepping for this assembly, he said, he had asked several colleagues, “Obviously, I’m missing something: Somebody’s got to benefit from this.” But when he asked around, to a person, everyone answered, “We just can’t see it.” ![]()