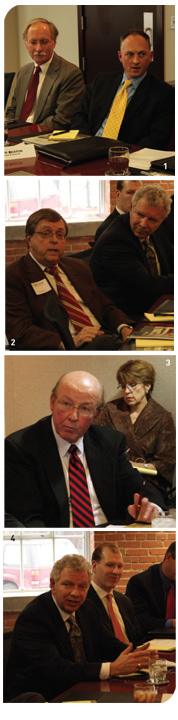

1: Ken Eaton, of Stepp & Rothwell, stresses the need for long term planning. Fred Dunn, of Haas & Wilkerson, agrees. | 2: Tommy Taylor, of Shughart Thomson & Kilroy, talks about the challenges associated with retirement. | 3: Bob Mulleedy (right), of Haake Companies, reports that as it relates to potential successors, sometimes wealth managers must be bearers of bad news. Brewster Ellis listens. | 4: Mark Revenaugh, of the Bank of Kansas City, talks about the impact of Baby Boomers. Chris Nelson, of The PrivateBank, considers his point.

“A down market is just a natural part of the cycle,” added Mark Vlasic, the director of the wealth management division with RSM McGladrey. “They are going to occur. They have occurred in the past. They continue and will continue to do so going forward.”

Without a doubt, though, as Vlasic explained, more client calls do start coming in. His goal is to proactively call and contact the clients and help them understand what’s taking place and how their plans have been structured to cope with a potential downturn.

“It is my favorite time,” said Don Hubbs, “because it is the opportunity to find the assets that are now under-valued and buy those.” Hubbs is the chief investment officer for The PrivateBank’s wealth management group. Hubbs counsels clients through these periods.“It’s really a good opportunity,” he added. “You just have to have clients who will sit down and listen to your explanation and believe enough in you to let you do that.”

Information Overload

The point was made that clients have much more access to information today than they did twenty years ago. Participants were asked how much of a challenge it was to stay a step ahead of them.

“There is so much [information],” affirmed Brewster Ellis. “The question is how much of it is accurate? It moves a lot faster, how right is it?”

“Information is worthless now,” elaborated Bob Rippy, “because it is free.” As he sees it, the value lies in “knowing what to do with the information. That’s where people at this table come in.”“I look at it this way,” said Don Hubbs wryly, “the more iPhones, iPods, cell phones, PDAs, and Blue Rays that are available to individuals, the more they look at someone like me and say, ‘Just manage my money.’”

Of course, not all clients are that easy to manage. Fred Dunn with Haas & Wilkerson Insurance observed that many clients have a gambling instinct. He wondered out loud how many of his colleagues indulged that instinct.

“Does anybody use the technique of essentially sitting down and talking to them: ‘Okay, well how much could you just afford to lose’?”

Mark Revenaugh with the Bank of Kansas City has a distinctive strategy for dealing with this issue. He tells those clients, “Take whatever money you can afford to lose and go [buy a speculative stock], but give us the money that you can’t afford to lose.”

Bob Rippy has “jokingly” told some of his clients, “Maybe you ought to just take a trip to Vegas because it’ll be quicker there.”Ken Eaton with Stepp & Rothwell does not encourage a client’s gambling instinct, but he has seen it at work.

“Sometimes [clients] hit the home run and they think they are the smartest person on the face of the earth,” said Eaton. “And then about two years later, they realize that they rode it all the way up and all the way down.” The challenge, he attested, is to help all clients plan for the long run.

New Business

The question was raised as to whether it was harder or easier to recruit new clients in a down market.

“We have added more new clients during down markets than up markets,” said Steve Toomey with BKD Wealth Advisors. In a down market, Toomey elaborated, people seek professional ad- vice. Humbled by the market, they come to reputable firms like those around the table, ones that approach investments holistically, in order to form a partnership with a trustworthy wealth manager.

In an up market, confirmed Chris Nelson with The PrivateBank, it’s hard to quantify how the advisor adds value because the client feels like he or she can do it or she can do it him or herself.

“The client really comes to an understanding of your process and the way you go about doing business,” Nelson added, “when you outperform in a market that is doing so poorly.”

As Ken Eaton explained, wealth managers do a good deal more for the client than manage portfolios. Most of what they do, in fact, is provide service. “It is helping them deal with their families. It’s helping them under-

stand how to transfer intergenerational wealth. It’s helping them do simple things [like refinancing a mortgage].”

As to strategies for recruiting new clients, Don Hubbs suggested that the best one is “serving the clients you have and keep providing good service, good advice.” This leads to personal referrals, easily the surest source of new clients.

The most reliable external marketing strategy is to maintain excellent relations with what Steve Toomey called “centers of influence,” specifically those accountants and attorneys who also work with the same clientele on related issues.

There is still apparently a certain advantage for large firms to spend money educating the consumers as to the types of work that they do. There is a down side, cautioned Mark Vlasic: “If it’s a big outlay, it is very hard to quantify what comes back in the door.”

These large ad expenditures can, however, help even those smaller firms that do not advertise like Stewart Koes-ten’s. “Many of our firms just have to be visible to consumers in order to capture the fallout from those firms,” said Koesten.

The one form of marketing that everyone agreed is dead, or very close to it, is the cold call. Said Bob Rippy, “It’s both ineffective and in many cases illegal.”

(...continued)