Shiny New Wheels

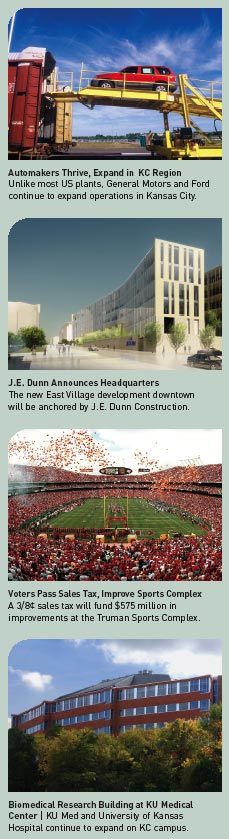

Wyandotte County could claim another major development with the announcement in late 2006 of more than $200 million in investment planned for the Fairfax General Motors Plant. The plant, which employees nearly 3,000 workers, received an approximately $5 million tax abatement.

The announcement related to preparation of the plant for production of the 2008 Chevrolet Malibu, expected to be a key factor in GM’s success in a market focused more on mid-size cars. The GM plant has already benefited from an earlier, major investment for production of the Saturn Aura, which began last fall.

The Claycomo plant operated by Ford Motor Company received some good news about the same time. The company’s management and United Auto Workers Local 249 reached a competitive operating agreement reported to provide additional flexibility as Ford works to increase its sales. The plant, which employs approximately 5,200 people, has reduced its force through buyout and early retirement packages, while bringing workers from closed plants around the country.

Other wheels were involved in BNSF Railway plans for a $1 billion transportation facility and warehouse park near Gardner. The proposal has drawn local opposition, but appears likely to be constructed in some form. The railroad has purchased 80 percent of the land for the project and voters in 2006 gave the city approval to proceed with annexation negotiations with BNSF—effectively agreeing to work with the proposal rather than fight it.

Kansas City International Airport in 2006 took a significant step toward realization of the Kasarda plan, a far-reaching blueprint for turning the underutilized airport into a major regional economic development engine.

Unveiled in 2005, the Kasarda plan calls for the use of more than 7,000 undeveloped acres at Kansas City International Airport as a catalyst for a “city within a city” based on high-speed air cargo business. In 2006, the city selected Trammell Crow Company as master developer for the KCI Business Airpark. The city of Kansas City, Mo. also bought the vacant Farmland headquarters to spur economic development at the airport.

Another public/private effort involves Richard Berkley Riverfront Park in Kansas City. Overseen by the Kansas City Port Authority, a plan was presented in 2006 to revitalize the nearby park and develop 55 adjoining acres as a multi-use area that could include up to 1,200 residential units. Estimated to cost from $40 to $50 million, the effort could take 15 or 20 years to complete. ForestCity Land Group, a Cleveland-based urban housing specialist, is studying a joint venture with the Port Authority.

Although unlikely to have an immediate impact on this area, the parent company for Kansas City’s second largest gam-ing facility, Harrah’s, was sold in 2006 for $17.1 billion. Apollo Management and Texas Pacific Group made no announcement regarding changes to their giant casino chain, including their casino and hotel in North Kansas City. They were expected to retain current top management.

Although details were still pending, Metro North Shopping Center and Metcalf South Shopping Center will be dramatically redeveloped. Interests of the Morgan and Dreiseszun families, which originally developed the two Kansas City area malls, in 2006 announced agreement with Alberta Development Partners, a Denver-area company, to jointly redevelop the properties. No plans have been released.

Other Big Buys

In October, Whittaker Builders Inc. of St. Peters, Mo., signed an agreement with Hallmark Cards Inc. to buy approximately 900 acres in Liberty for what is estimated to become a $2 billion residential and mixed-use development. Whittaker Builders is one of the largest residential developers in the state, with a half-dozen developments underway, primarily in the St. Louis area.

Kansas City-based Premium Standard Farms Inc., the second-largest pork producer in the U.S., agrees to an $810 million buyout from Smithfield Foods Inc., the world’s largest pork producer. Smithfield already owns locally based pork processor Farmland Foods.

A Los Angeles investment firm and Hertz Investment Group purchased the 30-story Commerce Tower in downtown Kansas City for $21 million. The Tower will continue to be managed by Tower Properties. Opened in 1965, the building had been listed for sale a year ago with an asking price of $24.5 million but was pulled from the market.

Three area senior living centers were part of a multibillion-dollar deal in December. Fortress Investment Group LLC agreed to buy 299 senior living communities in the United States and Canada, including three in the Kansas City area, from Holiday Retirement Corp. The value of the transaction was estimated between $6 billion and $7 billion. Local centers include Garden Village in Kansas City, the Carlyle in Lee’s Summit and Green-wood Terrace in Lenexa.

The sale of Overland Park Inter-national Trade Center to an Atlanta-based company was considered a signal that Kansas City real estate continues to attract national interest. Rubicon Investments LLC bought the building in May for nearly $50 million. The property was listed in July 2005, and marketing began that fall. ![]()