HOME | ABOUT US | MEDIA KIT | CONTACT US | INQUIRE

HOME | ABOUT US | MEDIA KIT | CONTACT US | INQUIRE

Since 2011, Ingram’s has delved deep into corporate revenue numbers compiled from direct surveys, interviews with key executives, public records and our rankings of top businesses by sector, to discern the largest private organizations—both for-profit and non-profit—in this marketplace. In those four years, we’ve learned who’s making big moves, who’s trying to hold ground as an organization, and even who’s shunning the spotlight by not reporting revenue figures, even though they would be assured a place in the Top 100. That latter point explains the absence of companies with nine-figure histories, such as American Century Investments, Adknowledge and Fike Corp.

But before we turn the pages to see who’s No. 1 this year—if you’ve been paying attention, that name will come as no surprise—or who’s No. 100, here are a couple of observations about the 2014 list:

• Interest continues to grow among companies that believe they have a shot at making Ingram’s Top 100 ranking. This year, more than 200 organizations responded to our requests for revenue and employment figures, the first time we’ve broken that barrier. Hundreds more were factored in by other reporting means, such as our Corporate Report 100 list of fastest-growing companies, which publishes in July.

• The bottom line is moving up—rapidly. When we launched in 2011, our radar was able to pick up plenty of big companies, but No. 100 on that list weighed in at less than $63 million in revenues. Efforts to identify more companies above that level, interest in participation from others, and plain old organizational growth (organic and through acquisitions) have driven that baseline number up to nearly twice that original figure, at this year’s $111 million.

• For various reasons, five companies from 2013’s list bowed out of this year’s Top 100 survey, and three others who reported revenues had their spots claimed by larger companies.

• The number of billion-dollar organizations holds steady based on 2013 revenues, with 22 of them reporting nine-figures or better.

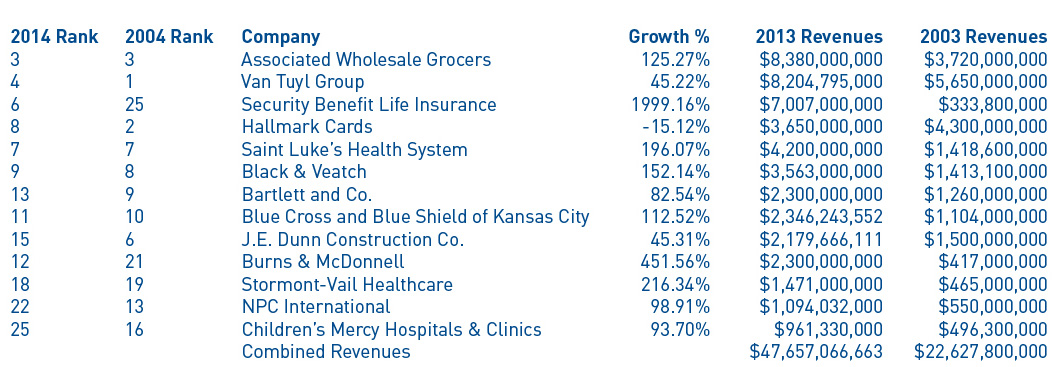

As we dive into the nitty-gritty of this year’s figures, let’s put them into a bit of historical perspective by going back a full decade. That gets tricky, because we only published a list of the Top 25 biggest companies in 2004, but that longer view also leads us to a few more observations:

The first is that consistency works. Fully 20 of the 25 largest organizations on our Top Private Companies list in 2004 are represented in this year’s deeper list, but 17 of those still command Top 25 rankings, and the three others are still big enough to claim Top 30 status. That’s impressive, because the growth figures for these companies as a group are all over the board, and their sectors posted dramatically different responses to something that occurred in late 2007 and for some still continues—the downturn that dare not speak its name.

Second, Darwinian economics is alive and well. The strong survive, the nimble adapt, and those who make strategic missteps will go away. That’s the case with five organizations as incorporated in 2004, including No. 4 on the list, the Sisters of Charity of Leavenworth Health System.

It sold the Providence and St. John hospitals on the Kansas side in 2012 and moved its headquarters to Denver. Bottom lines caught up with No. 12 Premium Standard Farms and No. 15 Union Securities, which dissolved after acquisitions in 2007, with No. 20 Wolfe Automotive Group, an incorporated firm separate from today’s limited liability company that operates under the same name, and with No. 24 Birch Telecom, sold to an Atlanta company in 2009.

And we affirm the principle that Big begets Bigger. One example of that is overall revenue growth that exceeds inflation. Of the 13 Top 25 companies from 2004 that are in the same quartile this year, only one, Hallmark, is smaller today than in 2004; each of the other 12 easily exceeded what might have been expected as a consequence of inflation alone.

Another example of the big getting bigger: Of those same 13 repeaters, the average rate of revenue growth is 277.2 percent, a figure skewed mightily by Security Benefit Life Insurance of Topeka, weighing in at a tad less than 2,000 percent growth. Burns & McDonnell recorded the second-largest percentage increase, with 451.56 percent growth. Four others—Associated Wholesale Grocers, Blue Cross Blue Shield of Kansas City, Stormont Vail HealthCare and Saint Luke’s Health System—all enjoyed triple-digit growth.

Which leads us to our final observation: Health care, now as then, is where you’ll find a lot of the action on this list. Fully 14 percent of this year’s Top 100 organizations are hospitals and medical centers (and that figure doesn’t include the University of Kansas Hospital, as a public health authority).

Then and Now

Thirteen companies from the Kansas City area made the Top 25 of both this year’s list of Top 100 Private Companies and Ingram’s Top Area Private Companies list in 2004. Here’s how they compare to their challengers, and themselves, after a decade:

Were this a horserace, we’d be calling out a new second-place challenger—one coming up from behind, and fast—with our 2014 review of the Top 100 Private Companies in greater Kansas City.

That’s because Lansing Trade Group, which a decade ago didn’t crack the Top 15 list of the region’s biggest

companies, even with $977 million in revenues, now stands tall at No. 2. Along the way, the company has charged past such luminaries as Saint Luke’s Health System, Black & Veatch, Hallmark and J.E. Dunn Construction. Lansing’s 2013 revenues of $8.84 billion are up an impressive 23.4 percent over its 2012 figures.

It still has a way to go to close the gap on Dairy Farmers of America, whose pace of 6 percent year-over-year growth (on a 2012 base of $12.1 billion) still affords a comfortable lead. But know this about the hard-charger: Bill Krueger’s team at Lansing has increased revenues by at least $1 billion every year for the past six.

Put that revenue increase figure into context: Only 17 other organizations in the Kansas City region even boast revenues that exceed $1 billion. It’s a performance, the company says, grounded in continuing development of long-term relationships, growth of operational assets and a series of acquisitions and partnerships within the industry.

Not surprisingly, that formula is working for many of the Top 100 Private Companies you see inching up the list this year. Interestingly, since we introduced this feature in 2011, the revenues for No. 100 on the list have consistently climbed as we’ve uncovered more qualifying companies and as revenues of others have surged. This year, No. 100 comes in above $100 million, the first time the final company in has topped nine figures.

As with each Top 100 Private Companies list, Ingram’s strives to include businesses that are either based locally or report market-specific numbers if they are national or global players. And, as in previous years, we recognize

that non-profit organizations are businesses, too, and make sure to give them their due for the position they’ve earned in this marketplace.